Refreshing the Brick-and-Mortar Capital Stack

Three new brick-and-mortar financing models bolstering the bedrock of the American economy

Today’s Thesis Driven is a guest letter from Safi Aziz, former Director at MetaProp and author of The Physicality, a newsletter that breaks down businesses building the real world.

There is nothing “small” about small business. 99.9% of U.S. businesses are categorized as such. They employ 46% of all US employees—61.7 million of us. Nothing encapsulates the American dream more than having your own brick-and-mortar store. Whether you live in the densest city or the sparsest suburb, we are surrounded by such businesses. 72% of consumers shop in-store every week. Brick-and-mortar is a bedrock of the American economy.

From where I sit on Graham Avenue in Brooklyn, I am looking out at Anthony & Son Panini Shoppe, a neighborhood staple since 1994, Williamsburg Dental Works, one of Dr. D’s three offices, and Monteman Barber, an upscale “men’s grooming salon” that opened two years ago. These local businesses make my neighborhood what it is. I decided to live here in part because of retailers like these!

Given how much brick-and-mortar commerce shapes our routines, it’s astonishing how difficult it still is to capitalize brick-and-mortar ventures. The layers of financing available to open, grow, and scale physical retail remains lacking.

Today's letter will tackle why that is as well as introduce three emerging financing models helping brick-and-mortar businesses scale: Sale-Leasebacks, Rent-to-own, and Repeatable Revenue Agreements.

Unsteady Capital Stacks

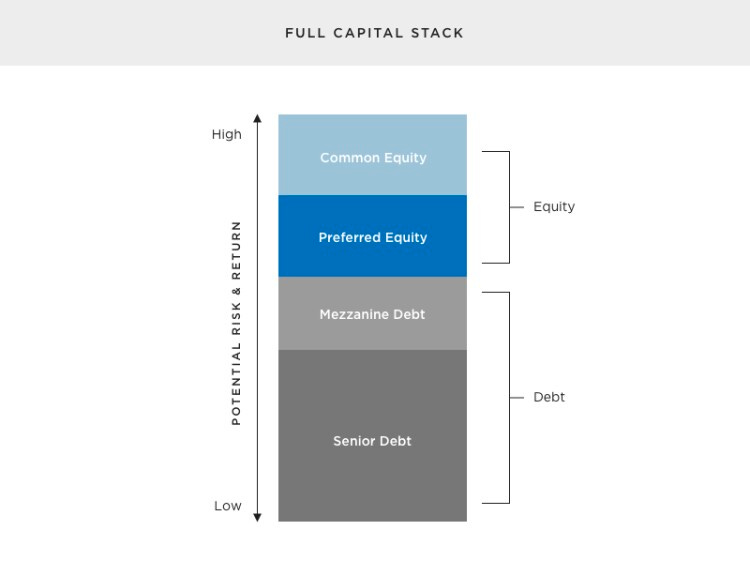

From the retail entrepreneur’s perspective, piecing together the appropriate capital stack can be complicated. Should they apply for a term or an SMB loan? What’s a merchant cash advance? Can they use these loans for equipment or is that another loan entirely?

Once that’s figured out, the application process, collateral requirements, and terms can vary significantly from lender to lender. The investors—banks, high net-worth individuals, family offices, etc.—can also be sluggish. These realities hinder brick-and-mortar businesses eager to grow.

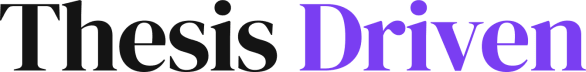

These factors left a vacuum that was filled by venture capital over the past decade. Venture money was alluring for a generation of founders trying to get their businesses off the ground: it was often quickly given, loosely monitored, and plentiful enough to cover the entire bill. Easy money led many entrepreneurs to expand too quickly with little regard for underlying economics. This led to painful retrenchments and failures as the market cooled; cautionary tales include Gorillas, WeWork, and most recently, Travis Kalanick’s CloudKitchens.

Venture capital can still be a great option to prove out a real-world concept, but not a great one to scale it. The return, timeline, and growth expectations on venture equity rarely, if ever, match the realities of four-wall businesses.

But what is a brick-and-mortar founder in 2023 supposed to do? As Fedor Novikov addressed in an essay earlier this year, there aren’t many straightforward options. There is a gap between what capital allocators want to give and what brick-and-mortar operators need.

But new solutions for retail entrepreneurs may be on the horizon. The three companies we explore below are trying to fill that gap–offering new kinds of capitalization to businesses like my Graham Avenue staples.

Three New Layers

Shrek said it best: capital stacks have layers. Each company we will break down is trying to improve on the capital stack in its own way. The companies and models we will dive into are:

Keyway: Sale/Leaseback

WithCo: Rent-to-own

Bonside: Repeatable Revenue Agreements

Sale-Leaseback

My dentist, Dr. D, is crushing it. Every chair is full. Patients, like me, keep coming back. Perhaps it's because we get to catch up on our Netflix while Doc pokes and prods our gums. He is ready to expand. But how will he finance it?

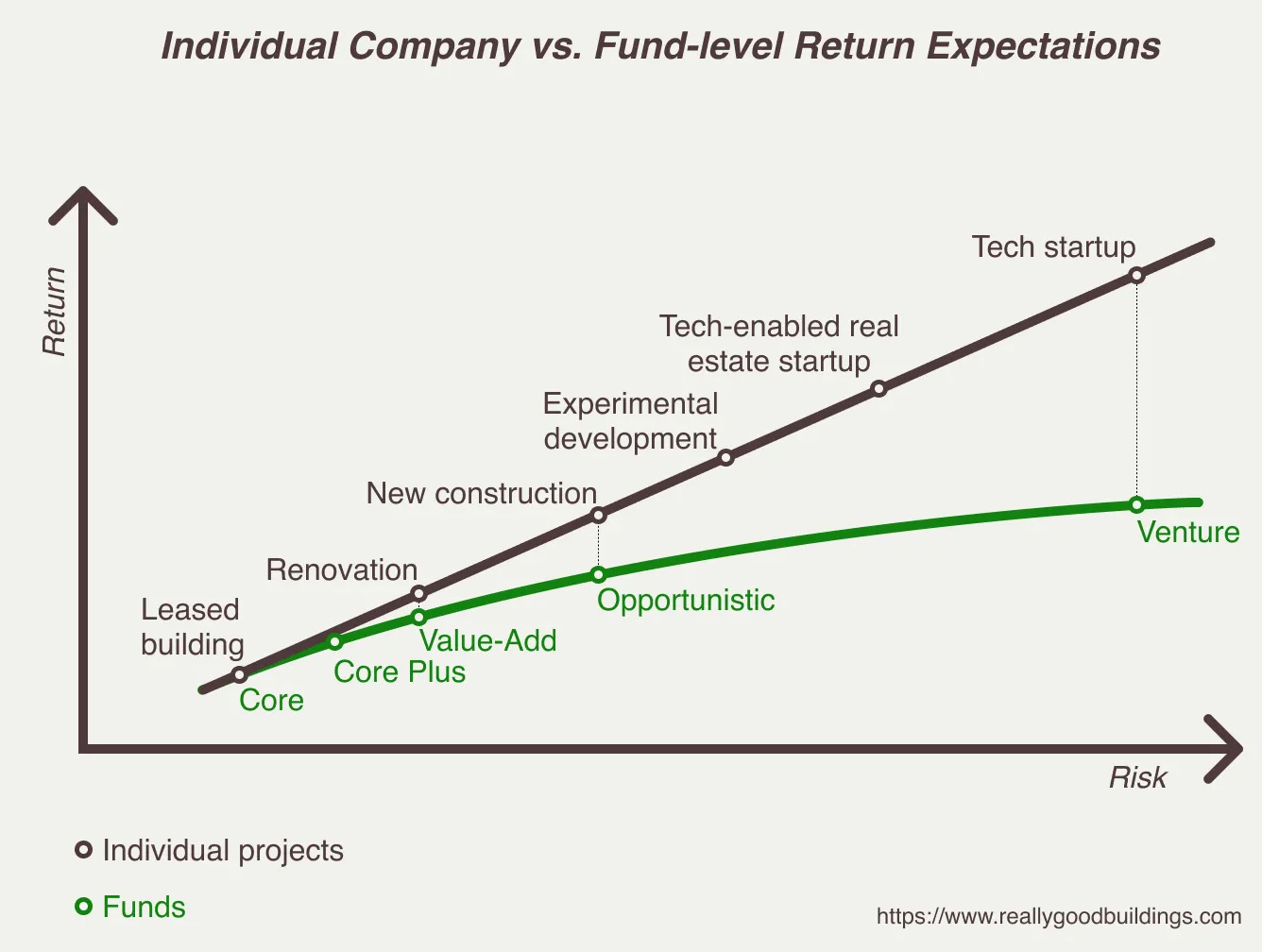

Before, he had three options: use cash, get a loan, or find investors. Keyway aims to provide a fourth option: a sale-leaseback. In this deal, Keyway would buy at least one of Dr. D's existing medical offices, immediately leasing it back to Dr. D so he can maintain occupancy with no business interruption. Now, Dr. D has the liquidity needed to open his next clinic.

Keyway began when its co-founders Sebastian Wilner and Matias Recchia observed rapid changes in the single-family rental market, which went from being highly fragmented—owned and managed by real estate gurus like your Uncle Greg and Aunt Joan—to having a significant institutional presence over the course of a decade.

For these institutional investors, each single-family home was peanuts. To make it worth their time and resources, they pulled a bunch of single-family homes together as a portfolio. The key insight here was scale. Startups got involved as well, introducing new angles to gain an advantage in the competitive single-family market. Truehold, for example, successfully leveraged sale-leasebacks to help seniors age in their homes.

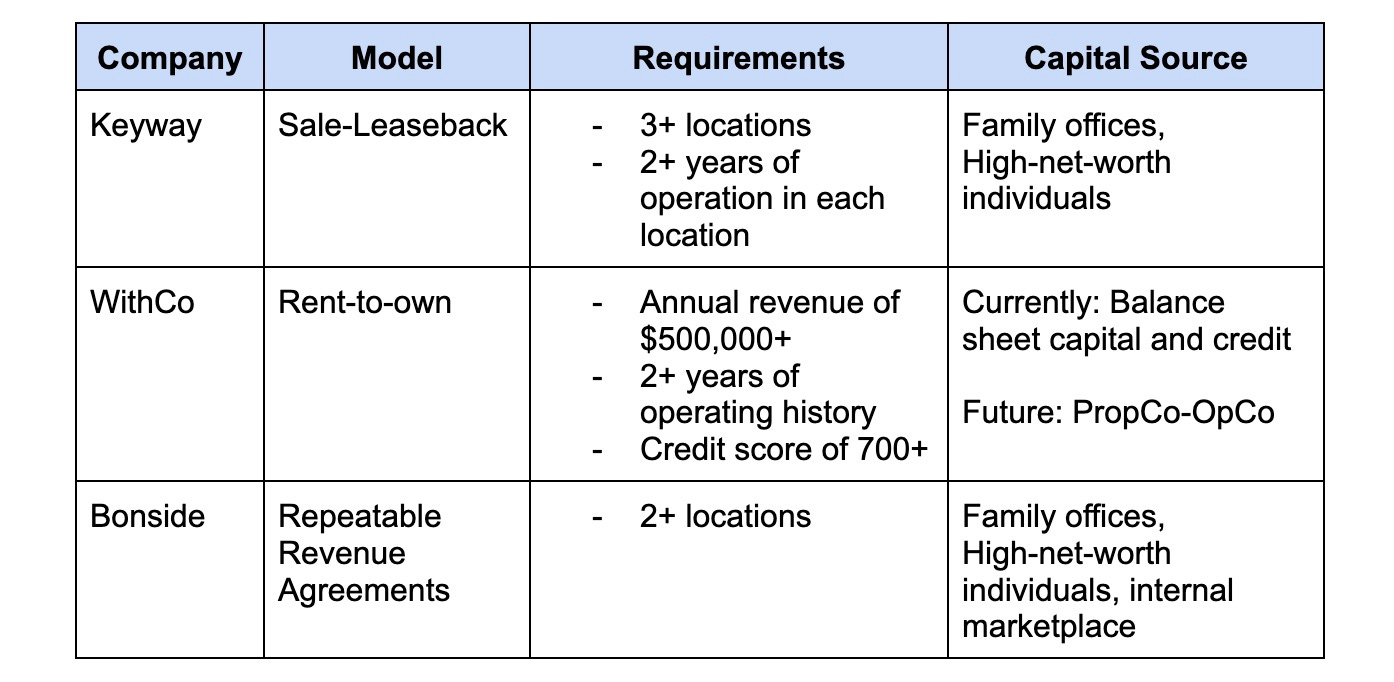

Inspired by the single-family sector, Keyway sought out real estate markets with similar dynamics. The landed on brick-and-mortar retail—specifically, medical offices. Medical offices were recession-proof and cash-flowing with sticky tenants. Keyway’s ideal customers for sale-leasebacks are medical clinics with at least three locations with two years of operation at each of them.

Keyway finances these assets with a variety of structures. Their most common is a fund in which Keyway deploys capital on behalf of family offices and high-net-worth individuals. Keyway finances the equity while working with banks to back the debt. Outside of the fund, they occasionally invest opportunistically on a deal-by-deal basis.

In total, Keyway has inked $70M worth of sale-leaseback deals to date. Since interest rates have altered the capital markets, the company is struggling to galvanize further investor interest in new deals. Keyway explains that cap rates haven’t moved in line with the cost of financing, making the opportunity cost of investing in real estate high when compared to other options. While customers can still apply for financing, Keyway is prioritizing other parts of their business until market dynamics change.

Of the three models, the sale-leaseback is the least transformative; Keyway hasn’t introduced a net new layer to the capital stack. Instead, they serve as the capital allocator, greasing the wheels with technology and data.

Rent-to-Own

Anthony & Panini Shoppe has been selling the best sandwiches in Brooklyn out of 433 Graham Ave since 1994. Hypothetically, let’s say they have been renting this whole time. As a retail tenant, Anthony’s wouldn’t be able to capture a fraction of the value they’re bringing to the neighborhood. Retail rent-to-own models–piloted by companies like WithCo–are looking to solve that.

In a rent-to-own model, WithCo purchases 433 Graham Ave. Anthony signs on for a 10-year lease with WithCo. Each year, 2% of that rent goes toward a “down payment credit”. After five years and a 10% down payment credit saved up, WithCo gives Anthony the option to purchase the building.

Anthony does not necessarily need to exercise the option after five years. However, if they opt to not purchase the building in year 5, the lease converts to “the greater of a standard market lease or our lease with continued agreed-upon rent appreciation” (WithCo). Basically, because WithCo is taking on the additional risk of Anthony remaining a renter and not a buyer, WithCo is getting paid more each month. This makes it clear that WithCo is not interested in being Anthony’s landlord indefinitely – they want Anthony to own the building. On the flip side, they allow tenants to purchase the building earlier than five years on a case-by-case basis.

WithCo turns brick-and-mortar operators into property owners. Founder Kevin Song was inspired to create WithCo because of his own family’s story; his parents bought a grocery store in Brooklyn shortly after immigrating to the States. After years of toiling to build this grocer into something great, they instantly lost it when the building was sold. Kevin founded WithCo as a way for entrepreneurs like his parents to remain in the neighborhoods they helped grow. Similar to the sale/leaseback, there is precedent for this in the SFH market. Landis, Divvy Homes, and Home Partners of America are utilizing the rent-to-own model to create more homeowners in America.

WithCo wants to solve three problems for small businesses at once:

It is hard for small business owners to be approved for a mortgage

It is hard for small businesses to save up enough money for a down payment

It is hard for small businesses to be chosen for a lease over established tenants like Starbucks

This model aims to better align incentives between retail landlords and renters. Operators will have a sense of ownership over the property and treat it well. And because the tenant is seemingly in it for the long haul, WithCo has more assurances that the tenant won’t churn and the property will be cash-flowing for longer.

Song tells me that they have financed “dozens of buildings worth multiple tens of millions of real estate.” According to the WithCo website, they “look for businesses with an annual revenue of $500,000 or more, 2 years or more of operating history, and a credit score of 700 or more.” Examples of businesses that have signed on are:

The Carriage House, a restaurant in Georgia that serves Southern cuisine from an 18th-century farmhouse

DealerMax Autos, a used car dealership in Florida

Cuco’s Kitchen, a Mexican restaurant in New Mexico that has been around since 1992

Retail real estate is in a very different place than it was when WithCo launched. WithCo’s initial batch of tenants was backed in 2021, which means they are eligible to purchase their properties as early as 2026. Kevin reports that none of WithCo’s customers have exercised early but remain interested in purchasing the assets they operate when the time comes.

The strength and weakness of WithCo’s model is that the deal is done at a fixed point in time. The price WithCo bought the building, the price they will sell it to operators, and the lease terms are all set upfront. Kevin acknowledges the tradeoff in a 2022 interview with TechCrunch, “We both enter into our partnership with the understanding that it’s the purchase price we’re both working towards, regardless of market conditions. Even in bad times, the incentives should still be aligned for our small business partner to want to convert.”

Given the stubbornly high interest-rate environment, I assumed the economics would be less attractive for WithCo to acquire new buildings. Kevin refutes that. He believes that these market conditions will create distressed retail assets that banks will be eager to unload, and WithCo wants to be acquisitive when that happens. While they constructed their initial portfolio on a deal-by-deal basis with venture equity and credit, they are in the process of raising a PropCo-OpCo fund to take advantage of the times.

Rent-to-own is meant for operators who envision themselves sticking around in one place. In contrast, we’ll close with a model built for rapid expansion.

Repeatable Revenue Agreements

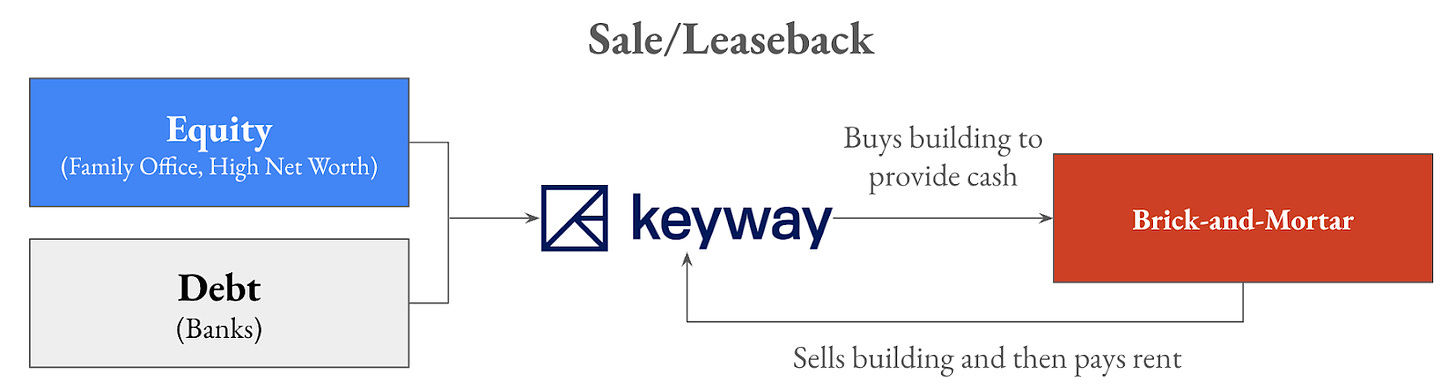

After seeing the success of his neighbor Williamsburg Dental, Monteman Barber is hypothetically inspired to expand. Unlike the dental clinics, Monteman Barber doesn’t own any of its locations. It could get a loan or save up money or it could use a Repeatable Revenue Agreement.

Bonside offers such a Repeatable Revenue Agreement. With this instrument, Bonside will provide Monteman Barber with $250,000 to $1 million upfront. In return, Monteman will pay Bonside 1-3% of their new store’s revenue over 3-5 years.

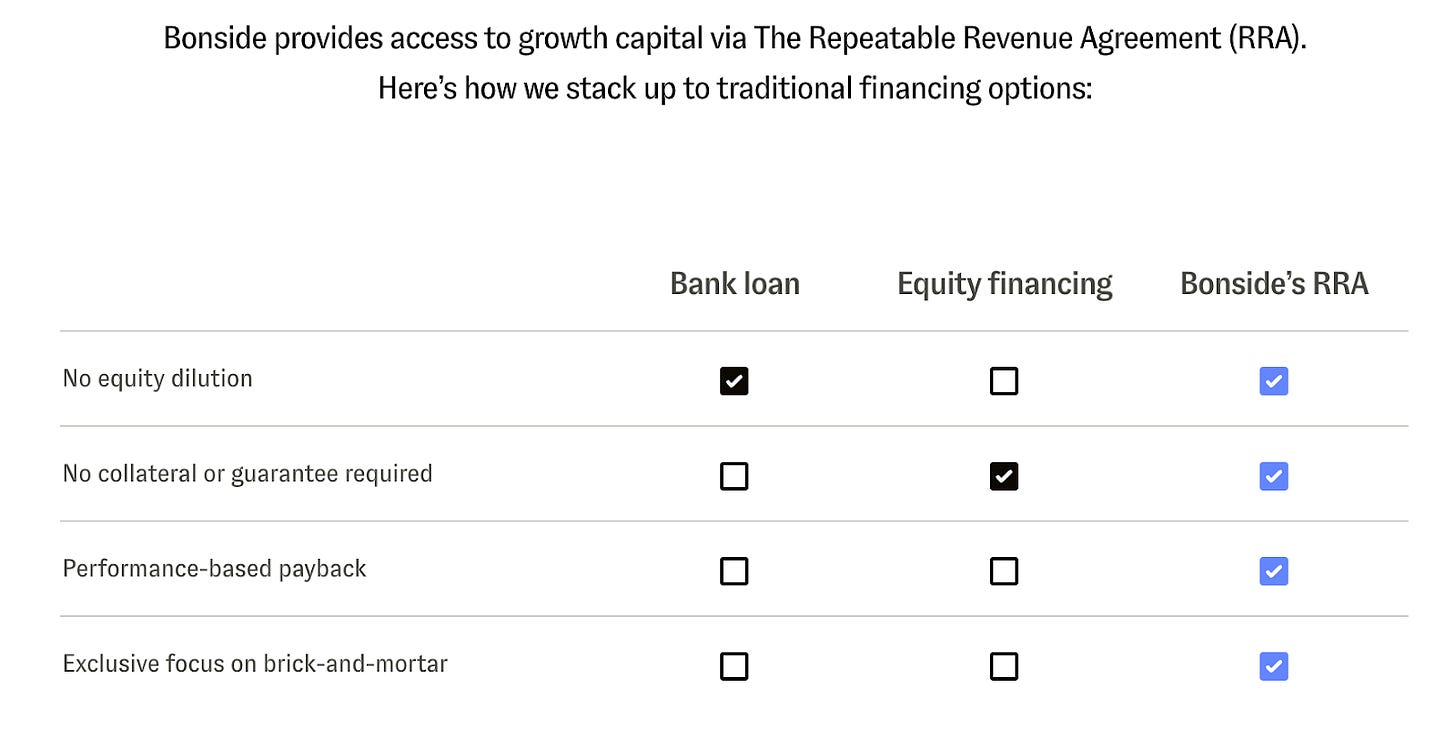

Here is how Bonside compares itself to the traditional capital stack:

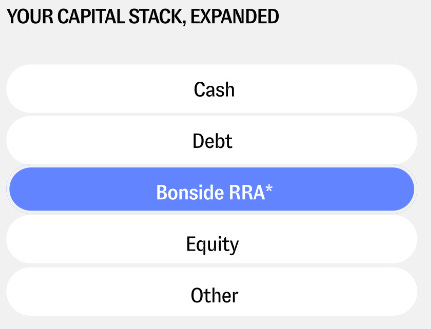

RRAs provide growth capital without diluting equity holders as venture capital does nor does it ask for personal guarantees like banks. They are aware that $250K slugs may not be enough for entrepreneurs looking to expand. So, they position its RRAs as a part of the capital stack – not a replacement for the whole thing.

Bonside’s product is meant to help companies scale, not get off the ground. To even be considered, Bonside requires that operators already have at least two locations. They’ve fully deployed their first $3 million fund across 10 businesses including:

Evolve Med Spa taking them from 8 to 12 locations

Jojo’s ShakeBar, taking them from 4 to 7 locations

Y7 STUDIO

Go Get Em Tiger

Spark Car Wash

Matchaful

Bourke Street Bakery

According to Fortune, “businesses in Bonside’s portfolio increased their location count by 30% since taking the startup’s funding.”

With this initial success, Bonside has raised an additional $5 million fund to run the same playbook. If they evenly distribute this new fund, they are backing 20 more locations.

Of the three models, RRAs have the least precedent. Yes, there are “Merchant Cash Advances” but they have much shorter term lengths of 6-12 months. Given the model’s novelty, it’s difficult to project out the economics.

Bonside seems to have diversified its fund between high-margin services like yoga and spas with trendy eateries like JoJo’s. The question is whether Bonside can get enough participating businesses to make the numbers work, as it’s unclear how much of a premium Bonside is taking each month. Even if it's a reasonable fraction, how much capital must they deploy for the business model to make sense? The realities of brick & mortar are zero switching costs, shifting consumer preferences, abundant competition, and inevitable losses. Will Bonside’s winners make up for the losers?

Of the three options discussed, this model is the most approachable. It makes for a great “starter” pack when a company needs to expand. Given its moderate check size and deal terms, it can work collaboratively with both Keyway and WithCo and add to its capital stack.

Refreshing the Brick & Mortar Capital Stack

Three different companies with three different approaches for the same goal: help brick-and-mortar entrepreneurs succeed.

Brick-and-mortar is seeing its own renaissance. Branded, tech-enabled medical offices from dermatology to veterinary continue to iterate. “Eater-tainment” plays like axe-throwing, escape rooms, and pickleball are emerging in more markets.

Whether it's a Main Street nail salon or a golf retailer in a suburban strip mall, brick-and-mortar retail remains a presence in our lives. But capitalizing growth and scale remains a challenge and keeps their future fragile, Companies like Keyway, WithCo, and Bonside are testing new models to make scaling brick-and-mortar more feasible. It’s about time we hit refresh on the capital stack.

–Safi Aziz