Capital Voids & Opportunities In The Current Downturn

Lessons from past crises and three key opportunities for entrepreneurial investors this time around

Co-author Paul Stanton is teaching Thesis Driven’s newest course, Fundamentals of Capital Raising, a two-day live bootcamp in NYC on June 19-20th providing an insider’s guide to raising capital for real estate projects from individuals, family offices and institutional investors.

"The time to buy is when there's blood in the streets." – Nathan Rothschild

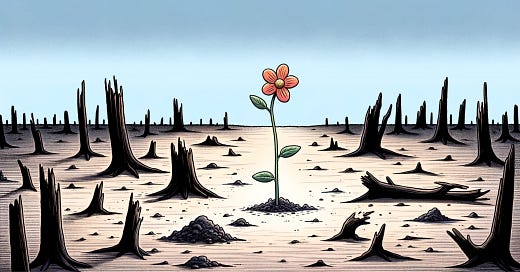

When capital markets get disrupted, voids are created. And when voids are created, big real estate opportunities for entrepreneurial investors emerge.

After the Savings & Loan Crisis of the late 1980s came the widespread adoption of REITs by players like Sam Zell. And after the Great Financial Crisis of 2008 came the institutionalization of the single-family rental industry by groups like Invitation Homes.

Neither REITs nor SFRs were popular prior to the economic downturns that preceded them. But those downturns created capital voids—in these specific cases, the need for new sources of liquidity and an option for the growing number of families who could no longer afford to buy a home.

Today’s letter analyzes the big real estate opportunities that might lie on the other side of today’s rates-driven crisis.

Specifically, we’ll cover:

Past capital markets downturns, and the trends that emerged;

Current opportunities institutional investors are capitalizing (on), and why;

Three big opportunities awaiting entrepreneurial investment;

Which entrepreneurial investors are set to capitalize on these big opportunities.