Capturing the Last Mile

The growing need for last-mile logistics drives a new generation of distribution centers that are very different than their predecessors, creating opportunities in unexpected places.

Thesis Driven dives deep into emerging themes and real estate operating models by featuring a handful of operators executing on each theme. The deep dives will give an investor enough context to understand the trend as well as opportunities for personal introductions to relevant GPs actively executing on opportunities. This week’s letter is on last-mile logistics and micro-fulfillment centers.

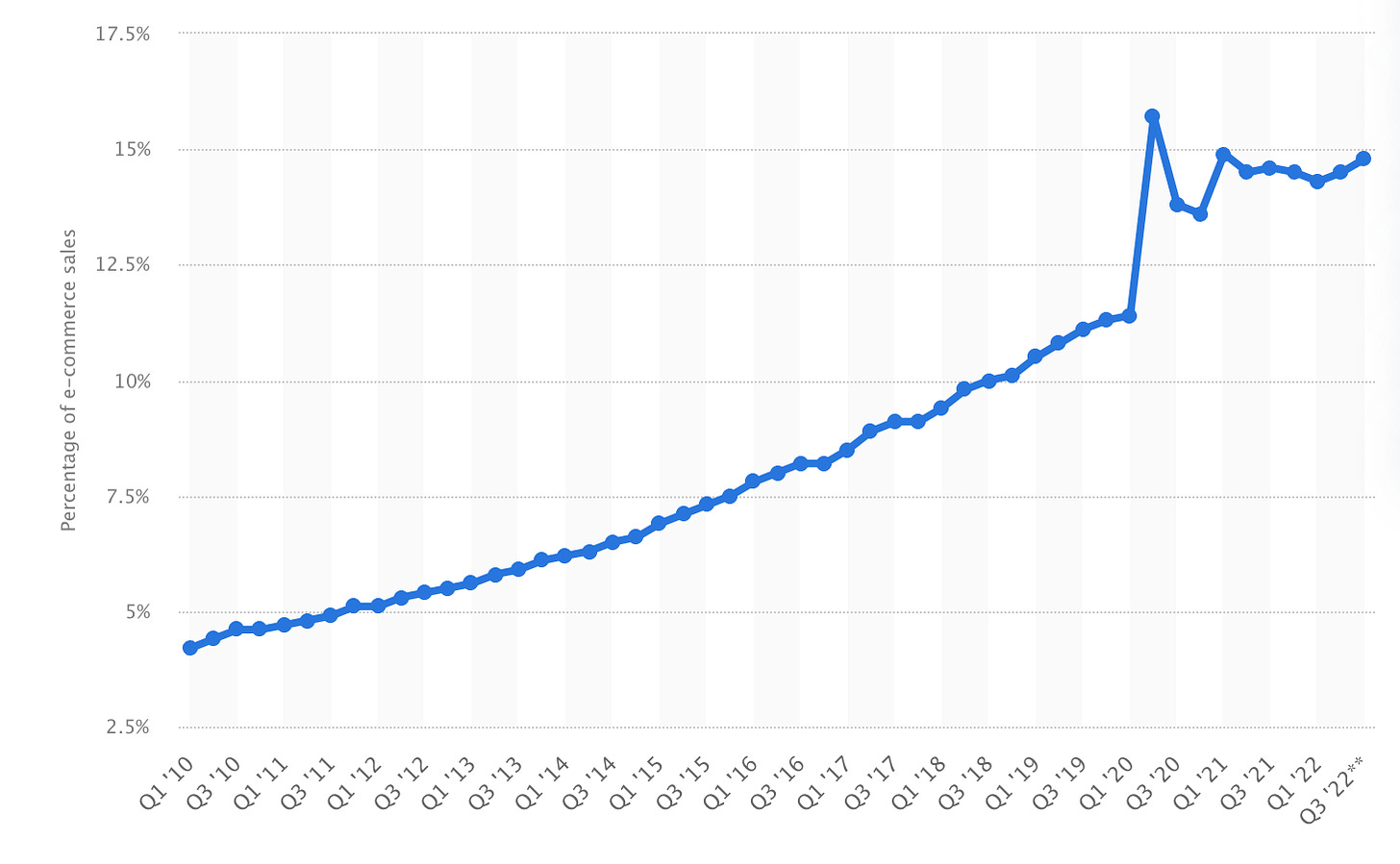

The steady yet accelerating rise of e-commerce is one of the most consistent macroeconomic trends of the past twenty years. Consider this: the share of all retail spend going to e-commerce will be back at COVID pandemic peak levels by the end of 2023 simply by continuing the natural rate of growth it has seen for over a decade.

As with many secular economic shifts, the rapid rise of e-commerce presents both opportunities and challenges to retail owners. On one hand, online retail poses a threat to many traditional brick-and-mortar retail models, although the urgency of the threat may be somewhat overblown: brick-and-mortar retail sales have grown 3 to 5% annually over the past decade despite e-commerce’s rise. But the opportunity presented by e-commerce is much clearer: online retailers need space—and lots of it—to store and ship their inventory. CBRE estimates the US will need an additional 330 million square feet of warehouse and distribution space by 2025.

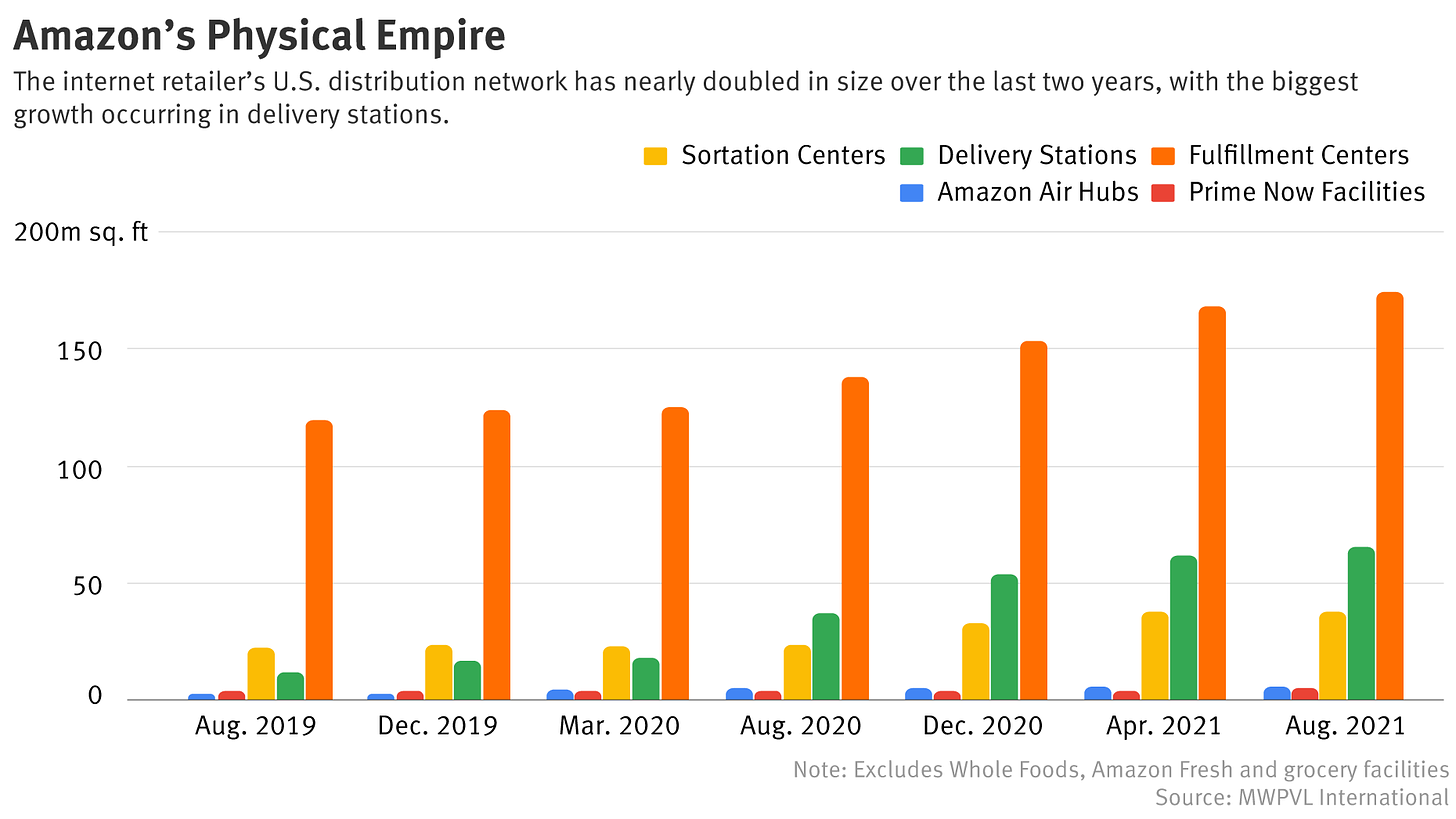

While Amazon is slowing its pace of warehouse growth after adding an all-time high of 79 million net new square feet in 2022, it is still projected to add an enormous 63 million square feet in 2023. This is after several years of historic growth—see the chart below—that made Amazon the largest industrial tenant in the US. And Amazon isn’t the entire picture; despite their dominance, they still control slightly less than half of the US e-commerce market.

As brick-and-mortar retailers, grocers, web-native brands, and more seek to compete against Amazon, they inevitably face the challenge of delivering goods quickly to their customers. If Amazon Prime can deliver a pair of boots to a customer within 24 hours, all but the highest-end footwear brands must be able to do the same, give or take. Unless they plan to spend billions building a global network of distribution facilities, those brands must rely on 3PL (third-party logistics) providers to make this happen. And as Amazon improves its network and the acceptable delivery window shortens, a new generation of logistics companies have arisen to empower all those e-commerce companies not named Amazon. And they’re setting up shop in some unexpected places, creating unique opportunities for real estate owners and investors.

Today’s Thesis Driven will dive deep into the real estate needs and economics of these new logistics companies bringing Amazon-speed delivery to the long tail of retailers and brands.