Five Trends Shaping the Real Estate Capital Markets in 2025

Changes on the horizon and what’s driving them

The first-ever online cohort for Thesis Driven’s “Fundamentals of Capital Raising” kicks off December 9th.

The course provides new and emerging real estate sponsors with a playbook to raise capital from individuals, family offices and institutional investors – alongside a community of peers to network, collaborate and share wins along the way. More info here.

With the election over and JPow cutting interest rates, many are hopeful that 2025 will see the floodgates open for the real estate capital markets, releasing the dry powder (currently at ~$400 billion) that has been sitting on the sidelines for the better part of two years.

But a lot has happened beneath the surface in 2024 that will shape how and where this capital flows—and from whom.

In the past 12 months, the largest asset managers have only gotten larger. And with groups like Ares now trading at 50x EBITDA, the largest firms are actively buying up smaller managers to realize immediate accretion and further their economies of scale.

Fortunately for these smaller funds, innovations in technology have allowed them to unlock retail capital at scale like never before. Juniper Square, a leading investment management software, has 200,000 high-net-worth individuals actively investing on its platform—with average commitments of $275,000.

Separately, the Odyssey Index’s inclusion of alternative real estate asset classes—like SFR, data centers and life sciences facilities—reflects growing investor demand for diversification and stable income sources, driving increased capital allocation to these sectors at both the institutional and retail levels. And with the continued evolution of infrastructure needs driven by AI, e-commerce and electronic vehicles, the size, scale and variety of alternative asset classes is poised for continued growth.

So where does this take us? This letter breaks down five trends we see on the horizon based on these macro shifts, specifically:

1. Increased consolidation of Asset Managers

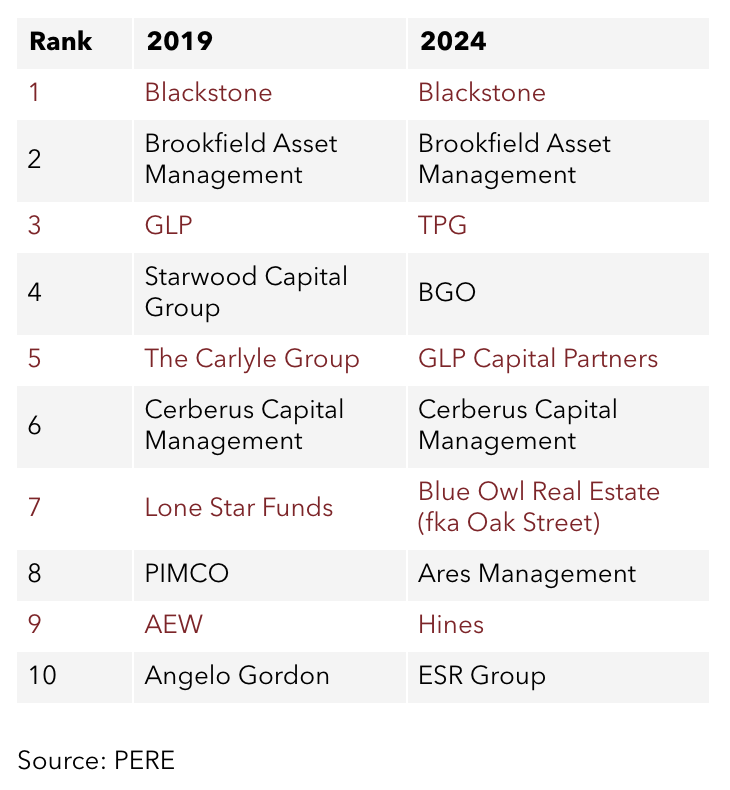

The asset management industry is experiencing a notable trend toward consolidation, as institutional investors such as pension funds, sovereign wealth funds, endowments, and foundations increasingly concentrate their real estate allocations among a select group of larger managers—driven largely by the desire for streamlined operations and enhanced risk management.

Consequently, large asset managers are actively acquiring smaller and mid-sized firms to expand their portfolios and bolster market share. For example, in October 2024, Brookfield agreed to acquire European logistics real estate firm Tritax EuroBox for $1.44 billion, underscoring the trend of larger firms absorbing specialized entities (in this case, warehouses and distribution centers) to diversify and strengthen their portfolios. Similarly, Ares recently announced it will double its assets through the acquisitions of GLP International in a transaction valued at $3.7 billion.