Five Ways New Real Estate Concepts Are Getting Funded Today

With fewer venture capital deals getting done, entrepreneurs innovating in the built environment are finding capital in new places.

Thesis Driven dives deep into emerging themes and real estate operating models by featuring a handful of operators executing on each theme. This week’s letter the first of a two-part series digging into the future of financing models for new real estate companies.

The past ten years saw many new real estate concepts come to market, from managed office to short-term rentals to new ways of buying and managing single-family homes. Many of those companies were backed by traditional venture investors, and a few of them even went public with technology-like stories and valuations.

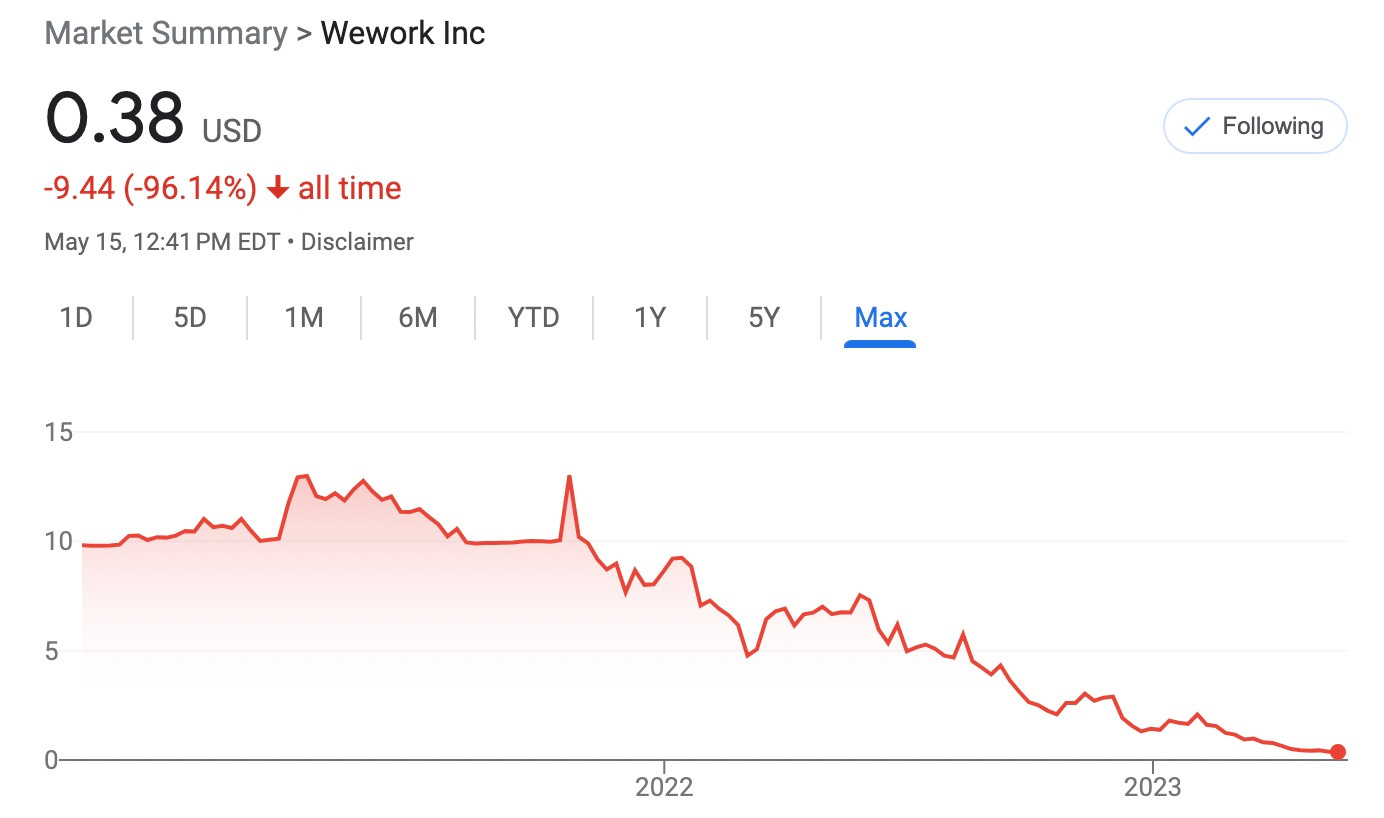

But over the past 12 months, the picture has gotten ugly. WeWork and OpenDoor, perhaps the two best examples of venture-backed real estate-related companies with financial or operating (rather than technological) innovations, are currently trading for a combined market capitalization of approximately $1.5 billion, more than an order of magnitude below their total funding raised. Companies like Sonder are fairing even worse; their current market cap is a mere $90 million.

I don’t believe these are bad concepts or even bad companies. The physical world is in need of creativity and innovation, and immense wealth can be built through real estate. But novel real estate business models are rarely technology companies, and venture capital is often the wrong vehicle to finance this kind of enterprise. Unfortunately, there aren’t many obvious financing alternatives for real estate entrepreneurs—but that’s beginning to change.

Today’s letter will dig into five ways that these concepts are going to get funded in the future across various stages of development from idea to scale. For each, we’ll dig into the typical structure, when and where it might be appropriate, and identify some examples of investors doing deals today.

OpCo-PropCo Structures

Co-GP Investments

Real Estate GP Incubators

Strategic Partnerships

Private Equity and Alternatives