How Real Estate Investors and Operators Are Using Location Data

Location data has dramatically improved over the past decade. How is the real estate industry taking advantage of these new insights?

Thesis Driven dives deep into emerging real estate themes and operating models. This week's letter is a guest post from Michelle Tan, Co-Founder and CEO of a stealth startup at the intersection of real estate and analytics. She was previously Director of Finance at Culdesac and part of WeWork. Today’s letter explores new sources of location data that real estate investors are using to inform their decisions.

As the saying goes, real estate is about “location, location, location.” But for decades, the way real estate investors and operators have used location data has largely stayed the same. In day-to-day decision-making, real estate firms spend significant time and effort analyzing financial data–such as rent comps and property P&Ls–but rely upon Google Maps and intuition for location data.

Over the past few years, however, new ways of leveraging location data in real estate have emerged, changing how investors and operators approach site selection, due diligence, and asset management. Today we will analyze the growing role location data plays in real estate, specifically addressing:

Where location data comes from;

Major categories of location data and key providers;

The evolution of location data over time, and

How each major real estate asset class can use location data to inform decision-making.

Where Does Location Data Come From?

Location data is defined as any data point that can be traced back to a geographical location on Earth; it could be a pair of longitude-latitude coordinates, a geographical area, or a land parcel.

There are 3 common sources of location data: public, paid, and proprietary.

Public sources: Government agencies collect and store large amounts of data. For example, the U.S. Census Bureau publishes demographic data; Energy Information Administration (EIA) has information about transmission lines; and counties have information about parcel boundaries and ownership. While these datasets are typically free, they are often not provided in easily accessible or consistent formats.

Paid sources (3rd party data): Paid sources provide access to data for a fee, often via bulk data file delivery or API access. There are two main sources of paid location data providers. The first type of provider analyzes smartphone, credit card, and consumer panel data to provide insights into consumer behavior. Examples include Unacast and Placer.ai for foot traffic and Experian for consumer segmentation. The second type enhances public data to make it more user-friendly, for example, Regrid for land parcels and Reonomy for ownership.

Proprietary sources (company internal data): Each real estate firm generates rich location data from its own operations. This is especially true for firms with a large number of assets or a long operating history. Data about current property performance, deal pipeline, and historical projects are important parts of location analytics.

Who Are the Location Data Providers?

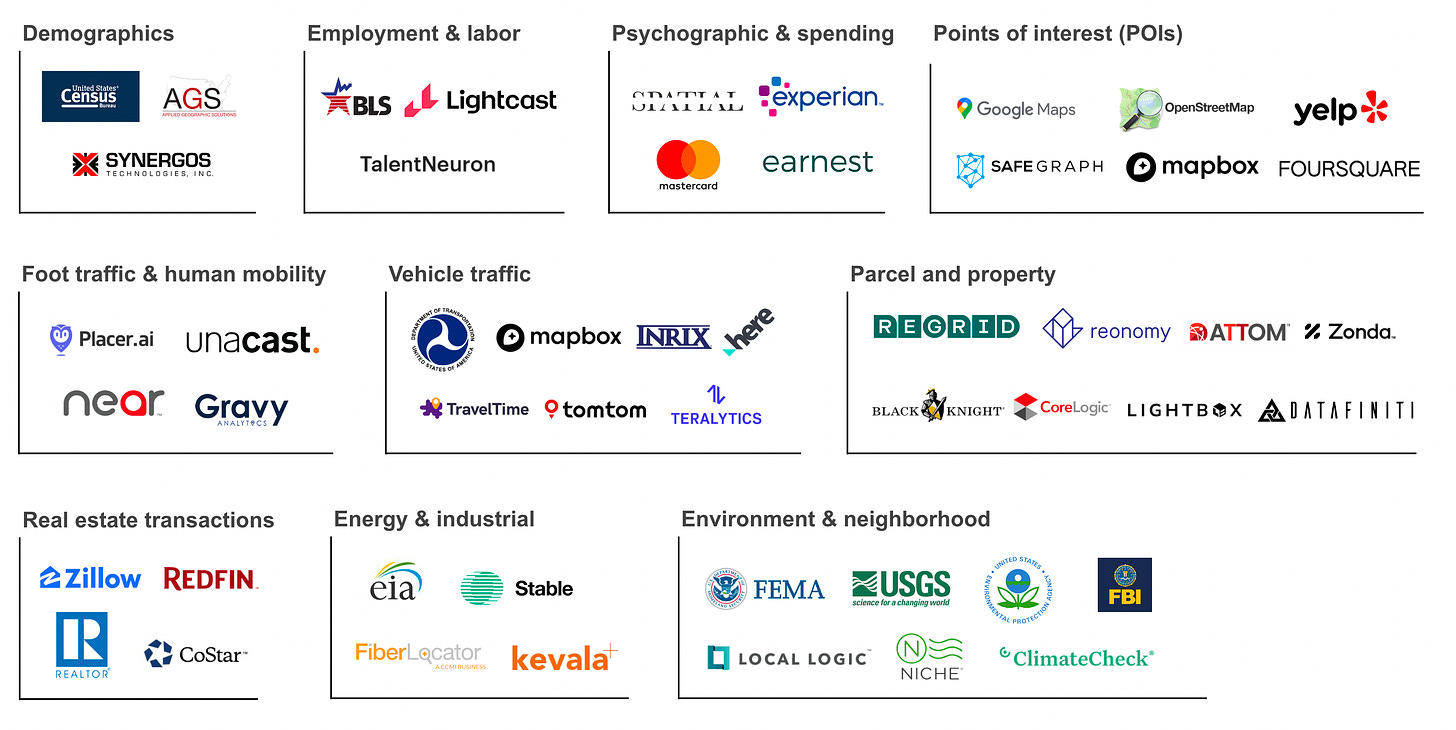

The following market map illustrates the landscape of major location data providers across 10 categories:

Each category of location data can help answer different questions for a real estate investor, so it’s worth a brief overview of each category:

Demographics: The U.S. Census Bureau publishes demographic data such as population, income, age, and ethnicity distribution for each census tabulation area (e.g. census tracts and block groups) after each calendar year. Providers like AGS offer current-year and forward-looking projections, as well as more granular demographic data than the U.S. Census. Demographic data helps real estate firms understand the population living near an area of interest.

Employment and labor: The U.S. Bureau of Labor Statistics publishes data on employment and wages on a county or MSA level. Lightcast is the most commonly-used labor analytics provider. They provide occupation, earnings, and labor market competitiveness data to companies looking to locate their offices and industrial sites.

Psychographic and spending: Psychographics is the study of consumers based on psychological characteristics such as values, goals, interests, and lifestyle choices rather than demographic information like age and income alone. Providers such as Spatial.ai and Experian utilize various data sources such as the U.S. Census, media and social media consumption, consumer panel, and credit card data to segment the U.S. population into a few dozen segments to help firms, especially retail owners and operators, gain a better understanding of their customers.

Points of interest (POIs): These are physical locations, often public amenities, such as retail stores, restaurants, or any other places that a certain audience cares about. Map providers and review sites such as Google Maps and Yelp offer POI data based on their consumer-facing services. Because POIs change as the built environment changes–such as buildings getting developed and new tenants moving in–accurate POI data is not easy to obtain. Providers like Safegraph specialize in keeping an up-to-date POI database. POIs help developers, investors, and retailers understand how neighborhood amenities, co-tenants, and competitors impact site selection.

Foot traffic and human mobility: Any mobile app we use that has a location or map feature has our location data. Foot traffic data providers such as Unacast and Placer.ai aggregate and anonymize data generated by mobile devices to provide information about the behavior of users, such as where they live and work, what stores they visit, and where in the country they move. These providers offer unprecedented insights into how people behave in the physical world and allow a physical business to have the same level of understanding of their customers as any online business that tracks click-through rates and conversions.

Vehicle traffic: The Department of Transportation in each state tracks vehicle traffic in major roadways and intersections. In addition to that, mapping and navigation providers such as Mapbox (which powers other mapping tools) and TomTom (which has its own GPS services) offer more granular vehicle traffic data, such as traffic volume by direction and fluctuation during different parts of the day. Vehicle traffic helps developers and tenants understand commute patterns in an area when they plan for new locations.

Parcel and property: Each county records real estate transactions, ownership, and parcel boundary data, but with 3,000+ counties in the U.S., it gets tedious to pull such information manually from the various counties’ websites. Providers like Regrid and Reonomy aggregate and clean up parcel boundary, zoning, and ownership data from counties to form a centralized database, making it much easier to access this critical piece of information.

Real estate transactions: Multiple Listing Network (MLS) is where real estate brokers publish home and property listings, but the MLS also provides valuable data such as the property sales volume and sales and rental prices that helps firms keep a pulse on the real estate market. Companies like Zillow and Redfin provide data on the residential market, while CoStar provides data on the commercial real estate market.

Energy and industrial: The U.S. Energy Information Administration (EIA) publishes information on transmission lines and substations, essential infrastructure for any industrial development that requires access to electric grid capacity. Providers such as Stable and Kevala help EV infrastructure and renewable energy developers gather data quickly to evaluate potential developments.

Environment and neighborhood: Environmental risks such as fire, flood, and climate change are becoming increasingly important to real estate asset owners, operators, as well as consumers. Government agencies such as FEMA (Federal Emergency Management Agency) and USGS (United States Geological Survey) provide valuable information about local risk factors and providers such as Niche and Local Logic are integrated into consumer listing services to help homebuyers understand an area.

The Evolution of Location Data

In the past, it was not easy for real estate firms to work with location data unless they were a firm like JLL or Prologis with big teams of GIS analysts. Location datasets often come in large geospatial files. Analyzing location data required specialized software with a steep learning curve, like Esri’s ArcGIS. Because of that, location data analytics was often either considered the specialty of urban planners or delegated to brokers.

Today, more real estate firms have started to bring location data analytics in-house, gaining more control over how they use location data to make decisions. This is partly made possible by the development of business intelligence software such as Power BI and Tableau. These tools make it easier for real estate professionals to engage directly with location data versus relying on a data analyst or GIS analyst. Real estate-focused data analytics tools such as Cherre help real estate asset managers further enhance their data capabilities.

The emergence of an ecosystem of location data providers also accelerated the adoption of data in real estate. Real estate professionals historically relied heavily on public sources for location data. Because the built environment changes constantly, the release schedules of the public data are often too infrequent for investors and operators who want more real-time information.

New sources such as mobile apps, navigation software, and social media provide location data that’s close to real-time and more granular than public sources. Instead of looking at the general population within a zip code or county from a survey last year, a real estate investor can understand how small clusters of people move and behave as recently as this month. This kind of insight about a location and the people around it was impossible before smartphone ownership became prevalent in the past decade.

How is Location Data Used in Different Asset Classes?

What sets real estate data users apart from data analytics in other industries is that each firm often has a distinct investment strategy which informs its approach to deal sourcing and due diligence. Therefore, each firm has a different set of location data needs, especially across asset classes.

Commercial real estate

Commercial real estate owners and operators have been early adopters of location data. Datasets such as foot traffic and consumer spending matter a lot to retail and office owners, whose asset value depends on their tenants thriving.

Haosai Wang at Boyd Watterson Asset Management said his firm uses foot traffic data from Placer.ai to understand return-to-office trends at assets they own. “Before Placer.ai, we would ask a property manager to sit at an office building for a day and count how many people go into the office. Using Placer is definitely a more scientific method.”

Brigham Dallas, Owner and CEO at Hello Sugar, a wax and sugar salon chain recently started using demographic and consumer spending data from AGS to inform their site selection process. “We added 50 locations in the last 12 months. Seeing the demographic and customer segmentation data on a map has been super helpful for us to expand our territories more strategically,” says Brigham.

Industrial real estate

Since the Infrastructure Investment and Jobs Act was signed into law at the end of 2021, industrial and infrastructure developments such as EV charging, data centers, and renewable energy have accelerated across the nation.

Compared to commercial real estate, the site selection criteria of industrial developers are often more complex and harder to gauge with intuition. While it's possible to estimate which roadways have busier traffic by driving around, it’s much harder to understand where water or natural gas lines are without displaying the data on a map.

Sean Kiernan is the co-founder and COO of EV Realty, a charging infrastructure developer for commercial EV fleets. He comes from the solar development world and has embraced location data since the start of his company. He led the development of an internal tool that takes in datasets such as vehicle traffic, electricity transmission lines, and zoning information and generates a proprietary site score to help his team evaluate a site quickly. “The value of the tool is to eliminate the noise — areas you don’t want to go. Then you get to a manageable size of opportunities and can apply rigorous analytics to figure out what’s good and what’s great.” says Sean.

Multifamily real estate

Multifamily real estate developers and investors have historically taken a much more “broad strokes” approach when it comes to working with location data. They use the education, income, and family size data of an entire submarket to approximate the demographic mix of their project. In comparison to commercial real estate investors, they are typically less focused on the data of a specific intersection or block at the hyper-local level.

This is starting to change as developers adapt to a new environment shaped by the revitalization of urban areas post-COVID, domestic migration from higher-cost coastal areas to lower-cost areas, and shifts in family formation and home-buying behaviors.

Roy Chen, Head of U.S. Real Estate at Gopher Asset Management invests in multifamily developments across the Southeast region. “Traditional real estate data such as rent comps and sales comps are lagging indicators of consumer behavior and are no longer sufficient for us to understand population migration within the U.S. This is why we use alternative data sources like demographic and foot traffic to help us predict the performance of submarkets we are entering into,” says Roy. His team uses the data for due diligence, unit mix design, and educating investors about new markets.

Closing Thoughts

While location data is powerful, up-front investment and team buy-in are needed to figure out the right datasets and tools and incorporate them into a firm’s day-to-day workflows. Here are a few examples of use cases where real estate firms can gain an edge by investing in location data:

Learning about unfamiliar markets: for firms expanding into new geographies or working with international LPs, location data helps them learn about a market quickly and communicate their thesis to stakeholders.

Emerging asset classes: emerging real estate uses ranging from renewable developments to ghost kitchens have new site selection and investment criteria, and location data helps investors and operators iterate their playbooks quickly.

Rapidly growing businesses or large deal pipelines: firms deploying assets at scale, such as building an EV charging network or rolling out a franchise nationwide, need to make a large number of location selection decisions from an even larger pool of options. Location data helps firms to filter out the noise so that they can focus solely on the good options.

“Data-driven decision-making” has long become a part of today’s corporate speak. Real estate as an industry has not been at the forefront of using data, largely due to the inaccessibility of location data and the complexity of decision-making in the physical world. There are reasons to believe that with the emergence of new datasets and analytics tools, this is changing.

While physical site visits are here to stay, a new generation of real estate decision-makers might take out an iPad on a site tour, look at the story the location data tells them, and run a back-of-envelope calculation in a couple of taps. Ultimately, location data is a tool to help real estate firms make more efficient and smarter decisions, making our physical world a more thriving and prosperous place.

—Michelle Tan