Our Ten Favorite Letters from Thesis Driven's First Year

A retrospective on the topics we've covered since September 2022

Thesis Driven is one year old this week. We published our first letter—on office-to-residential conversions—on September 29th, 2022. Since then, we’ve published over 60 letters on topics ranging from new cities to historic tax credits to all manner of real estate investment sectors. We’ve featured 14 different authors ranging from veteran real estate developers to designers and entrepreneurs. We’ve also interviewed more than 200 operators over the course of the past year.

To celebrate our first birthday, I’m picking my ten favorite letters from our first year as well as sharing some lessons learned. We’ll be back with our regularly weekly deep dive on Thursday.

#10. Unlocking Atoms with Bits

Last December we dug into the world of data-driven real estate investing: companies using algorithms and big data to inform real estate investment decisions. It was the first letter in which we profiled technology companies themselves in addition to real estate operators. (The fact that several of the companies in this space are venture-backed tech-enabled real estate operators themselves—such as Constellation Homes—made this straightforward.)

But we also explored pure tech plays like CityBldr that are aggregating data investors can use to inform their decision-making. This was a first for us at Thesis Driven. While we’re adamant that Thesis Driven not become a proptech publication, technology is often the catalyst behind new kinds of real estate investment strategies and capabilities and therefore worthy of our attention.

Unlocking Atoms with Bits

This letter features software companies attempting to make real estate investing more scalable by leveraging large public, private, and proprietary data sets.

#9. ‘PropTech’ Needs to Die

While most Thesis Driven letters attempt to be informative and impartial, we’re not beyond the occasional op-ed. This one took on the “PropTech” sector not from the perspective of Luddism but rather in hopes of ending real estate tech’s obsession with venture capital.

While VC money serves a role for certain companies—it’s probably necessary if you want to take on Yardi or CoStar—’PropTech’ as a category is a amalgamation of lots of businesses for which venture money is inappropriate.

This letter was the second of a two-part series on the future of financing real estate innovation; the first part explored alternatives to venture capital that could be good fits for new brick-and-mortar real estate concepts. Some of those models—such as real estate accelerators and OpCo-PropCo models—have been covered at length in other Thesis Driven letters over the past year.

'PropTech' Needs to Die

This letter is the second of a two-part series exploring the future of financing innovation in the built world. It digs into the definition of "PropTech" and the problems it causes for companies at all stages.

#8. Where Are the New Cities?

When it was published earlier this year, this letter was by far our weirdest: we catalogued and analyzed all the serious attempts at building new cities happening around the world from Egypt’s new capital to some crypto-backed projects taking shape in the Nevada desert. We also invented a novel rating system for new cities involving cranes (🏗️), brains (🧠), trains (🚇), and bone saws (🪚).

This was the first letter in which I really just picked a topic I found compelling and ran with it without a lot of thought as to whether it was a fit for my desired audience. And it did great, which freed me up to have a lot more fun with Thesis Driven.

Where Are the New Cities?

This letter is on the creation of new cities. There is no domain of real estate investing as ambitious—or insane—as the creation of new cities. Between the massive amount of capital required to achieve critical mass and economic viability and the long list of past failures, there is good reason why most real estate LPs stick to investing in well-established metropolitan areas.

#7. What “Branding” Means for Twenty-First Century Real Estate

Karen Zabarsky Blashek’s dive into real estate branding and design didn’t draw the attention of some other letters on this list, but it was one of my favorites we’ve published in the past year.

I love it because it tells the story of creating brands for places at three different levels: at the asset level, at the neighborhood level, and at the city level. And it does so through exclusive interviews with some real estate stars who have built extraordinary things and used branding to add tremendous value to their assets and their communities.

The letter is also aesthetically beautiful, using photography of the projects being discussed to paint a picture of the brands that were built. Not my usual Midjourney cruft.

What “Branding” Means for Twenty-First Century Real Estate

This letter is a guest post from Karen Zabarsky Blashek. Karen is the founder of Ground Up, a creative studio for the built environment. It dives into how real estate developers are using branding to create new identities of place.

#6. Everything You Need to Know About Raising a PropCo

While we’ve written at length about OpCo-PropCo models here at Thesis Driven, this letter was my favorite. It was based on interviews with real estate operators with recent experience raising PropCo capital, providing us with a behind-the-scenes look at the investor conversations, structuring tradeoffs, and market conditions that make an OpCo-PropCo model work.

Even people with significant experience raising private equity or venture capital can get tripped up when going out to market for real estate money. Thesis Driven’s letters about OpCo-PropCo and co-GP models always draw a lot of readers, speaking to the need for both new kinds of financing and a better understanding of these concepts and how they work.

Everything You Need to Know About Raising a PropCo

This letter digs into PropCo models from an operator’s point of view, including key structuring questions and fundraising tips.

#5. The Rise of Car-Light Communities

My sincerest political view is that we must be more willing to create spaces that free us from car dominance. I come to this view as a parent of two young kids whose world is depressingly small due to the constant presence of multi-ton metal boxes going at high rates of speed piloted by ever-more angry and distracted humans—even though our family lives in Manhattan, the most walkable place in the United States. Cars are the leading killer of kids in the US, and it’s not particularly close.

To that end, I have tremendous admiration for the developers who are pursuing this vision despite the myopia of our leaders. For this letter, I profiled four real estate development projects that are putting cars in the backseat, prioritizing walkability and active streets. Some of them—such as Blackwood Groves in Bozeman, Montana—have since gone on to get a lot more (deserved) attention and accolades.

The Rise of Car-Light Communities

This week's letter explores “car-light” communities that prioritize walkability and density over parking and speed.

#4. On the New City in Solano County

Regular Thesis Driven readers know that I have a lot of interest in new cities. So when news of a 50,000 acre assemblage outside San Francisco hit the news in August—backed by technology titans with plans to build a new city—I had to write about it.

Getting the right tone was challenging here, as the press coverage of the project to date had been uniformly negative. On one hand, you don’t want to join in the dogpile on an ambitious and much-needed concept. California needs a lot more housing, and the kind of dynamism represented by new cities is good! But the California Forever team had made mistakes that not only jeopardized their own work but probably made similar projects more difficult in the future.

That being said, they’re making a serious attempt to create something new and have brought on some very talented people. That’s good, and it’s worth analyzing what they’re doing on the merits rather than dismissing it offhand as tech money at play. Hopefully I was able to hit that balance here.

On the New City in Solano County

This letter discusses California Forever, the group behind a proposed new city in Solano County, California. Last week, the New York Times broke the story of Flannery Associates, a secretive group that has spent over $800 million buying over 50,000 acres in Solano County, California. The Times revealed that Flannery is an affiliate of California Forever, a group backed by tech leaders including Marc Andreessen, Michael Moritz, and the Collison brothers.

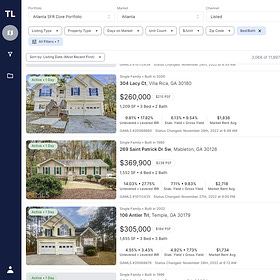

3. Small Multifamily Real Estate

Michael Falgione’s two-part deep dive into the world of small multifamily real estate investing remains one of our most successful letters to date. Over the course of over 5,000 words, Falgione explores the history and future of small (2-50 unit) multifamily deals by profiling three investors building their businesses buying small apartment buildings.

Small-scale multifamily is interesting because it’s a massive segment of the real estate market that has yet to be institutionalized, offering investors higher yields and the occasional undiscovered gem. But the high variability among small multifamily properties makes it much more difficult to standardize than (say) single-family rentals or self-storage. Investors looking to scale this strategy must use technology to help them identify, underwrite, and manage large portfolios of small multifamily buildings.

It’s the perfect Thesis Driven topic: an emerging real estate sector offering outsized returns to investors willing to take some risk and get creative with how they do business.

Small Multifamily: Real Estate's $5T Opportunity (Part 1)

This week’s letter the first of a two-part series by Michael Falgione, co-founder and Managing Partner of Greenspace Capital, diving into the world of small multifamily real estate investing.

#2. ReSeed and the Accelerator Model

ReSeed is one of the most interesting real estate businesses launched in the past year, and I was fortunate to have a conversation with Rhett Bennett and learn about it for this letter. While there has long been talk of a “YCombinator for Real Estate,” ReSeed was the first to tackle the thorny problems of alignment, exclusivity, and fundraising that have stymied past attempts.

And they did so by building an organization that over time will likely look more like Greystar than Techstars, leveraging a distributed network of GPs that share a single set of underwriting models, reporting packages, software, and LP investors but maintain their entrepreneurial identities and local market focus. With ReSeed’s first cohort kicking off now, I’m looking forward to continue covering them in the years to come.

YCombinator for Real Estate: ReSeed and the Accelerator Model

This letter explores the potential of real estate accelerator programs like ReSeed, which hopes to give real estate entrepreneurs a boost while helping large investors access sub-institutional deals.

#1. The Curious Case of Colony Ridge

My favorite Thesis Driven article of the past year was our deep dive into Terrenos Houston, a massive development tailored to immigrants—many of them undocumented—currently being built on the outskirts of Houston. We dug into the development’s issues with local government as well as the developer’s questionable lending and foreclosure practices.

This was probably the closest we’ve come to true investigative journalism here at Thesis Driven, exploring previously-unpublished details of one of the most unique development projects happening in the United States today. While I don’t intend to spend a lot of my time chasing down scandals and scoops, it’s a muscle we want to have. The real estate industry isn’t all sunshine and rainbows, and it’s helpful to have the capacity to look beyond the marketing language and dig in where needed.

The Curious Case of Colony Ridge

This letter explores Terrenos Houston, a large-scale master-planned development in east Texas. Over the past decade, developer Colony Ridge Land has built the equivalent of a mid-size city in the piney woods northeast of Houston, Texas.

While we’ve covered quite a bit of ground, we’re really just getting started. Over the next year, expect to see a higher volume of writing—I’m aiming to make two letters per week the norm—as well as more products that complement the newsletter such as our Developer Database, which will be launching in public beta in October.

Thanks so much to our loyal subscribers for being on the journey with me. Much more to come.

—Brad Hargreaves