Plotting a Sponsor’s Next Move

Identifying the right type of real estate investors and capital structures through five capital raising scenarios

Raising capital for real estate deals is like playing chess. To grow thoughtfully, sponsors always need to be thinking a move (or capital raise) ahead. But the game—and what winning looks like—depends on who is playing.

Some sponsors are playing to build generational wealth, while others want to build nearer-term fee streams. Some are playing for control–to operate and grow as they please. While others are looking to scale at any cost.

There is no right answer.

But once a sponsor decides what game they’re playing, they can begin mapping out their growth strategy—which requires assessing where they are today, where they want to be in 7-10 years (real estate is a long game no matter what version you’re playing), and what type of investors and investment structures will get them there.

In today’s Thesis Driven letter we’ll assess the “next move” for five different sponsors and their growth scenarios:

Value-add multifamily investor building a long-term portfolio;

Industrial sponsor outgrowing family office;

New, tech-enabled SFR strategy needing a track record;

Fast-growing self storage platform facing liquidity crunch;

Established student housing sponsor scaling to new markets.

For each sponsor’s scenario we’ll discuss the right investor types and structures, how they work, and the pros and cons of each go-forward strategy.

Note: In Thesis Driven’s Fundamentals of Capital Raising course, we help students build out their own sponsor profiles and capital raising strategies–and provide the playbooks to execute.

Investor Types & Structures

Before diving into the specific scenarios, we need to lay out the different investor types and investment structures we’ll be matching to each sponsor scenario.

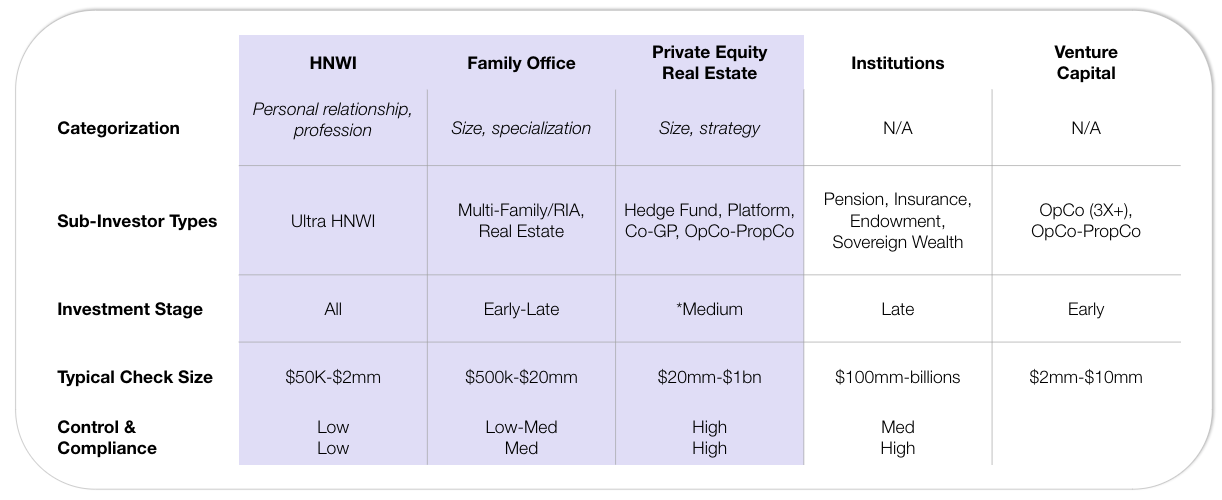

Investor types can be broken down into the following general categories: high-net-worth individuals (HNWIs), family offices, private equity real estate funds, institutions, and venture capital (we’ve covered some of these in a past Thesis Driven article, The Five Investors You’ll Meet as a Real Estate Sponsor).

High-Net-Worth Individuals (HNWIs): Often seeking diversification and yield, HNWIs typically value personal relationships and may invest for reasons beyond pure financial gain, such as tax benefits or legacy planning. They are passive investors and typically pay the best fees.

Family Offices: They can write large checks (in comparison to HNWIs), often with a focus on long-term wealth preservation. They are passive and flexible investors paying high fees, but their investment mandates are constantly changing and building a relationship takes a long time. More on family offices in a previous article Painting a Picture of the Family Office Investor.