Real Talk About Our Choices

An assessment of the policy proposals on the table from a real estate perspective

We Americans face a choice on Tuesday whether we like it or not.

The built world and real estate industry are inextricably linked to policies at the state, local, and federal levels.

I’m not going to tell our readers how to vote. Most of us have already made up our minds, and even if we haven’t I’m skeptical a real estate trade writer would drive the decision much one way or another.

But we at Thesis Driven do have strong opinions about specific policies. Most of the policies we discuss—from building code reform to the role of fire departments to family-friendly housing policies—are primarily at the local level where most land use decisions are made.

But this election sees an unprecedented number of policies proposed at the federal level that could have a tremendous impact on the real estate industry and built world. So while political dialogue in our nation is as toxic as it has ever been, let’s put on our HAZMAT suits and dig in, one policy at a time.

(Note that we’re only going to focus on policies that we believe will have a major impact on the real estate industry.)

Tariffs

While free trade has fallen out of favor among both parties, Trump and the GOP have been particularly vocal about proposing aggressive tariffs: a minimum of 20% on any imports, 60% on all goods from China, and far higher fees on select other goods. In practice, this would return tariffs to levels not seen since the 1930s, basically unheard-of in a modern economy.

Given the volume of construction materials and supplies that come from overseas—including China—it’s hard to overstate the impact this would have on our ability to build things. The US is the world’s largest importer of steel, for instance, with imports making up about a third of US steel usage. Any tariff on steel would undoubtedly increase the price of steel significantly. The same story could be told for any number of construction inputs; we import a quarter of our cement as well as significant amounts of electrical equipment, piping, roofing materials, and much more. Overall, about 32% of US construction material is imported.

While it’s probably a smart strategic move to re-shore much of this production, doing so will take time and is dependent on a bunch of other reforms required to make US manufacturing competitive. A “tariff-first” approach is likely to make most ground-up development even more infeasible than it already is, driving up input costs and decimating the construction sector.

The US also doesn’t act in a vacuum; Trump’s proposed tariffs are almost certainly going to trigger retaliatory tariffs from friends and rivals alike. While nobody is quite sure of the final impact, the tariffs as they’re proposed are likely to cost average Americans thousands of dollars and have a meaningfully negative impact on GDP.

Taxes

With a couple exceptions, the candidates’ tax proposals are not directly taking aim at the real estate industry.

Harris’s proposed $25,000 tax credit for first-time homebuyers will likely accelerate already-strong home price growth at the lower end of the market. But her plans also seek to limit like-kind (1031) exchanges to $500,000 in gains, taking a major real estate tax strategy off the table. Harris has also proposed taxing unrealized capital gains for individuals worth more than $100 million—a problem for the largest real estate investors but potentially devastating for growth-stage tech founders.

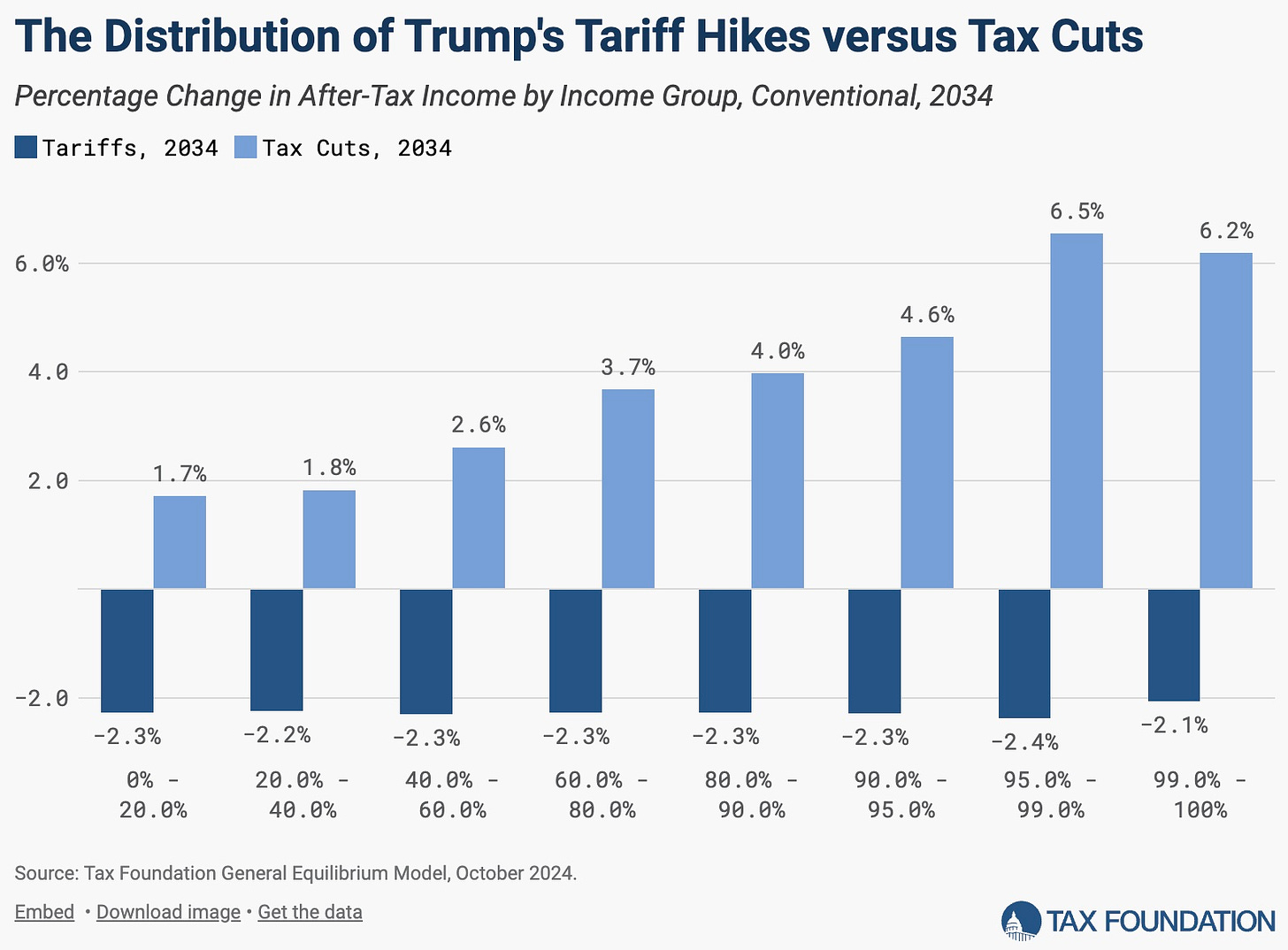

On the flip side, Trump plans to lower long-term capital gains taxes, a nice bonus for long-term real estate investors. And his tax policies are overall likely to put more cash in the pockets of the type of people who invest in real estate.

While Trump’s tax plans are generally more favorable to the real estate industry, I don’t anticipate that either candidate’s proposals would have the magnitude of impact on the real estate industry of some of the other policy changes proposed here. Of course, the very concept of taxing unrealized capital gains—even if it applies to relatively few people as currently proposed—is deeply concerning.

Independence of the Federal Reserve

The robustness of the US real estate sector is due in no small part to the independence of the Federal Reserve. By acting independently of political goals and whims, the markets trust the Fed to behave predictably when it comes to setting rates. This allows lending to happen and capital markets to function.

While the US system doesn’t always get it perfectly right, it’s not hard to find examples of politically-driven central banks doing much, much worse. Influenced by Erdogan’s esoteric personal economic views, the Turkish central bank sent inflation to a high of 85% annually in 2022 before slowly cooling things down—by raising interest rates to 50%.

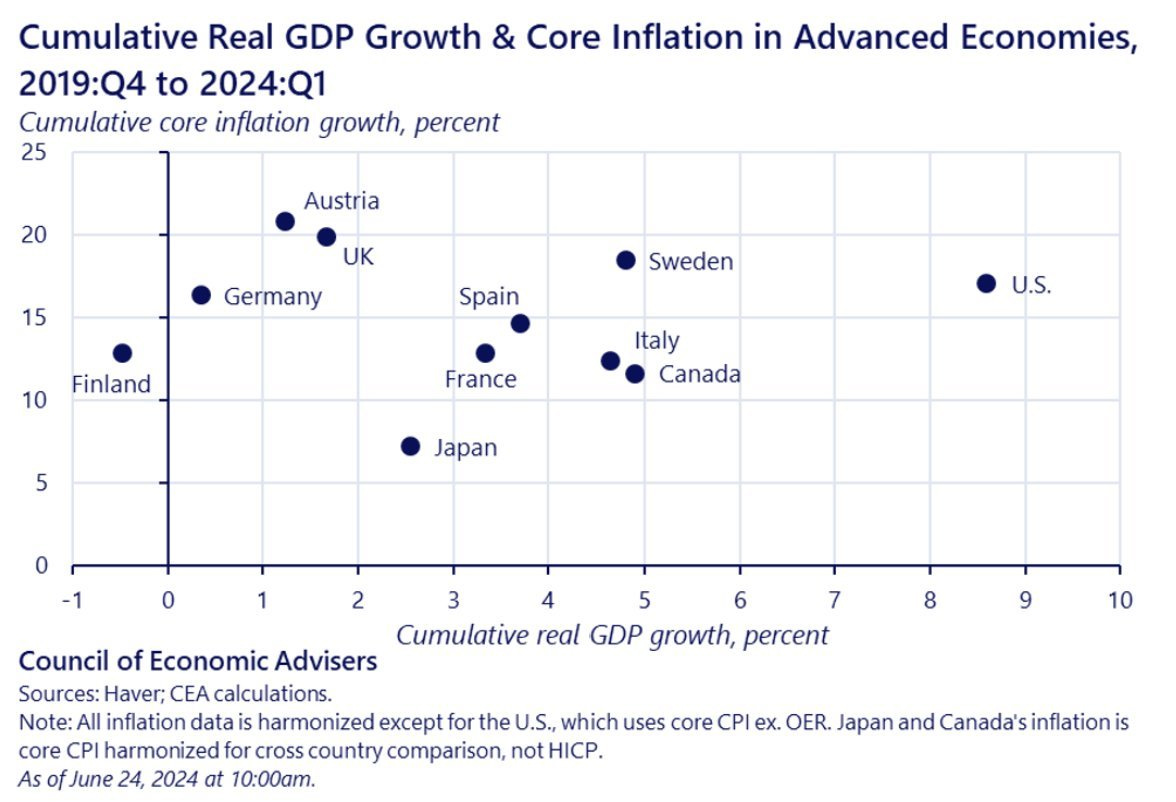

In the US, the Fed was able to navigate a global wave of inflation far better than most of our peer nations, achieving the elusive “soft landing”—for now. Among developed nations, the US has experienced a period of unparalleled growth relative to the inflation we’ve endured.

Trump, however, has signaled a desire to play a direct role in influencing Fed decisions, effectively ending the institution’s political independence. And there’s plenty of reason to believe that Trump would intervene to send interest rates higher; he criticized Powell last month for “cutting […] too quickly,” and Trump’s former Federal Reserve pick advocates for a “zero inflation” target. Some believe that the 10-year Treasury has continued to rise over the past six weeks not due to growing fears of inflation but due to a growing belief that Trump will win the presidency and drive rates higher.

While higher rates would undoubtedly make things tougher for the real estate industry, the end of Fed independence would have long-term and potentially dramatic consequences for the US capital markets ecosystem. Without confidence that the Fed won’t bend to political whims—regardless of the party in charge—investors and lenders will be less willing to do business and make long-term bets. And once the precedent of independence is broken, it’s very hard to get back.

Deportations

The border is as politically charged as they come, and I’m not here to make a moral assessment of policy proposals—only an economic one.

Depending on who you believe, the GOP plan to deport all undocumented immigrants would require removing anywhere from 11 to 15 million people. Aside from the direct cost of finding and deporting that many people, doing so would likely cut US GDP by 4.2 to 6.8%, putting the country in a deep recession on the order of what we experienced in 2008-9 when GDP fell by 4.3%.

The recession would likely hit the real estate industry particularly hard given the role undocumented immigrants play in the construction industry. Immigrants make up 20% of the construction industry’s total workforce, and up to half of those immigrants are undocumented. In addition to providing labor, undocumented immigrants have helped us stave off a massive skilled trade shortage by bringing skills in carpentry, plumbing, electrical, and more. Even if construction firms were willing to pay more to hire US citizens, we simply don’t have the skills, and it would take years and a fundamental shift in young peoples’ desire to go into the trades to make up the gap.

Disappearing 11 to 15 million people would also present a massive demand shock to the housing market. While many on the right are seeing this as a feature rather than a bug—in theory, rents and home prices should decline—it’s unclear why anyone in the real estate industry should support solving the housing crisis by reducing demand as opposed to unlocking supply. After all, our nation has below replacement rate fertility, so it’s not like natural population growth will allow demand to “catch up” at some point in the future. It’s possible that the US real estate development industry would simply never recover as demand for new housing stabilizes at a far lower level in the coming decades.

Of course, those who support a mass deportation policy will likely do so despite the economic cost. But I’m skeptical the broader US population has the appetite for the scale of this kind of operation once they get a taste for what it would look like in practice.

The Deficit

The US’s deficit in FY2024 sits at $1.83 trillion, up $130 billion from last year.

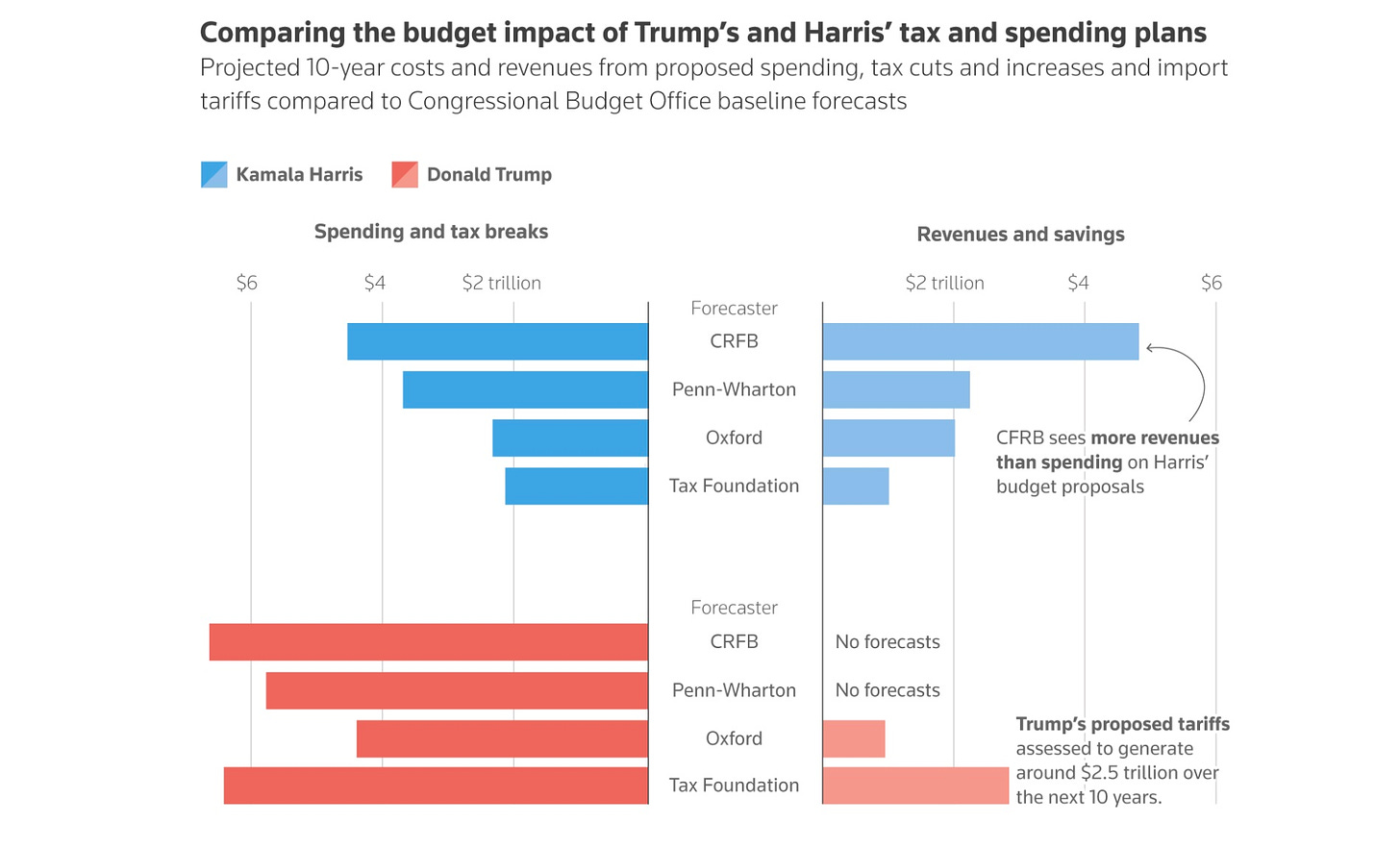

Neither candidate has a meaningful plan to address the deficit, and both candidates’ proposed policies would only grow our budget shortfall. But most analysts agree that Trump’s policies would be worse.

The Wharton Budget Model, for instance, estimates that Harris’s economic and tax policies would increase the deficit by $2.0 trillion while Trump’s would increase it by $4.1 trillion. In the Wharton analysis, most of Trump’s deficit increases come from tax cuts. Notably, they don’t attempt to model the economic impact of mass deportations.

Interest payments represented 17% of the US government’s budget in 2024 and are—of course—highly sensitive to interest rates. Any threats to the independence of the Fed would also further erode our nation’s financial health by increasing borrowing costs.

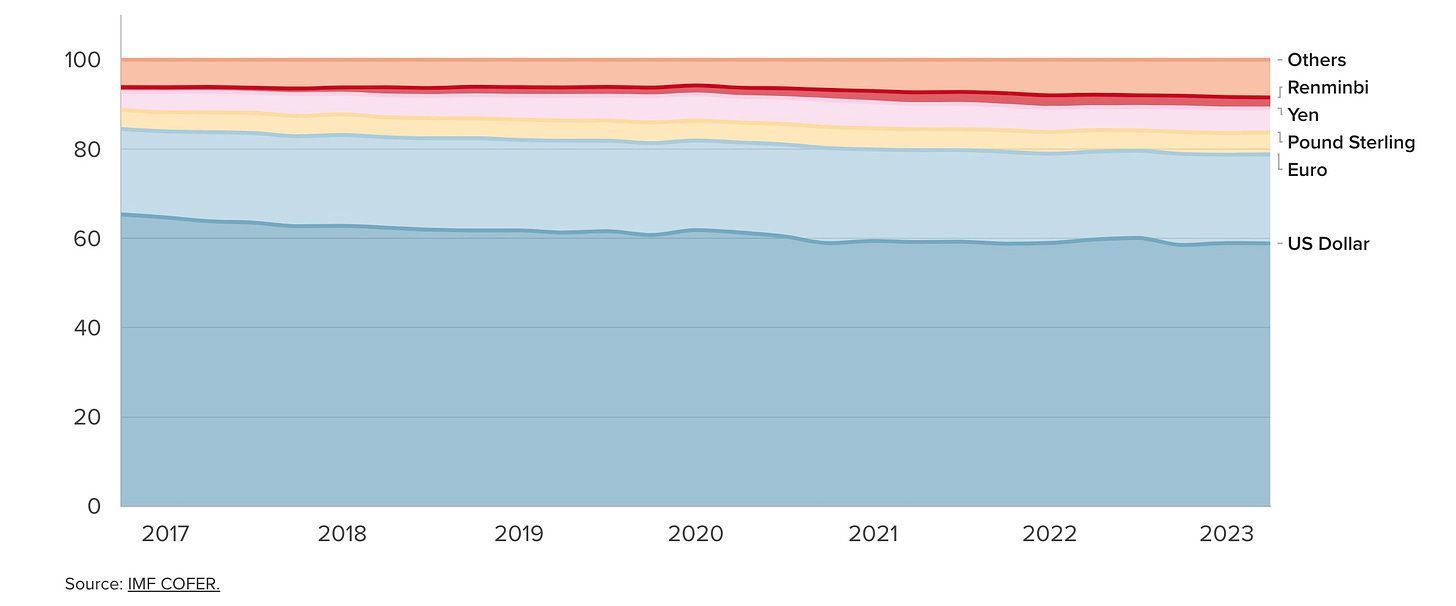

There is disagreement among economists as to how much the deficit actually matters, particularly given the US Dollar’s continued run as the global reserve currency. But our country’s stability—and central bank independence—is undoubtedly a major contributor to our currency’s reserve status.

Netting it Out

People pick their candidate for any number of reasons. I have friends who are voting for Trump because they’re deeply concerned about the security of the border in ways that go beyond any economic argument. Other friends are voting for Harris because they care about women’s rights and democracy. And some friends are voting for Trump because they’re angry about how Democrats handled COVID.

I’m not going to pass judgement here on any of that. (Other than one friend sitting it out for Gaza, I’m absolutely judging them.)

But it’s exceptionally hard to make an economic argument for voting for Trump, particularly if you’re in the real estate industry. It requires real creativity to invent a person in the real estate industry who would unquestionably benefit from Trump’s policies as laid out given their broader negative macro impact. Perhaps a 1031 exchange broker exclusively doing industrial deals? A high net worth individual with more than $100 million in unrealized gains? They’d benefit, perhaps, while the rest of the industry struggled.

This isn’t some fringe left-wing view; Trump’s advocates openly admit his policies would have a major negative impact on the economy but you should vote for him anyway for other reasons.

And that’s fine—there are things more important out there than the economy and money. But don’t kid yourself that Trump’s policies are good for the real estate industry or the US economy as a whole.

—Brad Hargreaves