Single-Family Rentals on Steroids

How investors are enhancing yields via new consumer financial products and operating models.

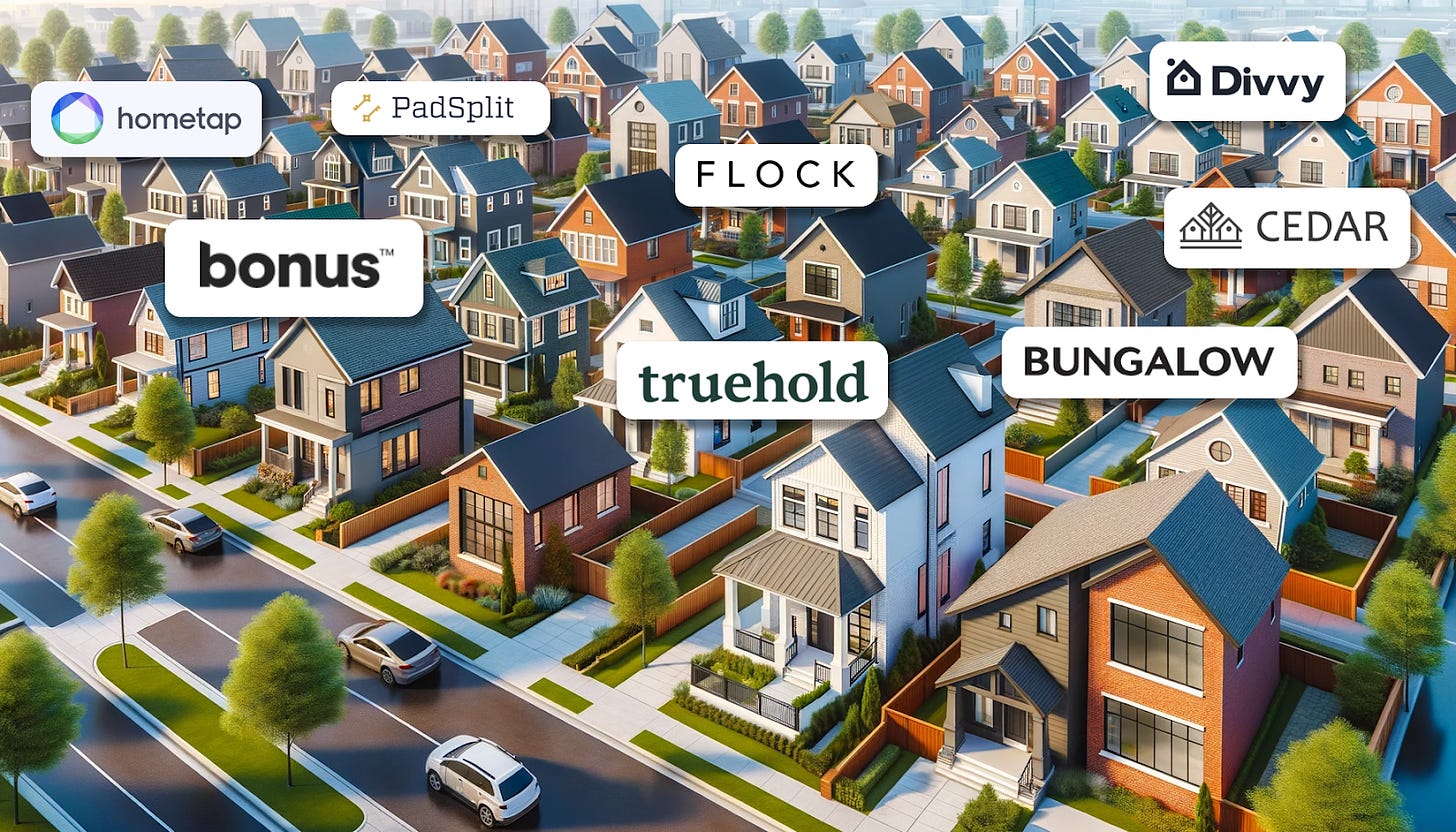

The single-family rental industry, once seen as a straightforward proposition, is undergoing a period of rapid innovation.

As the global economy shifts, and as Americans’ perspectives on home ownership, investment, and community change, niche business models—like rent-to-own, shared appreciation, and co-living—are growing in popularity.

But these models are not only helping consumers.

They are also helping institutional SFR investors struggling to find acceptable risk adjusted returns for single-family acquisitions or developments in the current interest rate environment. In the first quarter of 2023, Invitation Homes had a net absorption of -103 homes (i.e., they bought 194 and sold off 297) compared to +675 in the first quarter of 2022.

So to start buying again, institutional groups are turning to niche models to enhance their investments.

In this article we’ll highlight:

Why SFR investors are currently on the sidelines

Owner Incentive models, and how investors can leverage them to acquire homes

Investor-Renter Partnership models, and how investors can enhance and secure income

New Operating & Niche Market models, and how they generate premium returns

Current adoption of these models, and what’s next?