Six Lessons from Six Months of Thesis Driven Courses

What we’ve learned teaching the fundamentals of real estate

Today’s Thesis Driven is an inside look at our education programs. We’ll be back tomorrow with our regularly scheduled Thesis Driven letter.

Real estate finance is second nature to those who have been in the industry for decades. But for those new to real estate, learning the ins and outs of the sector can be a steep learning curve.

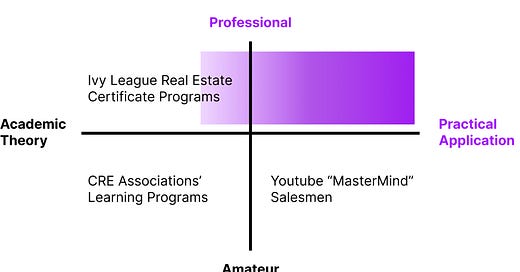

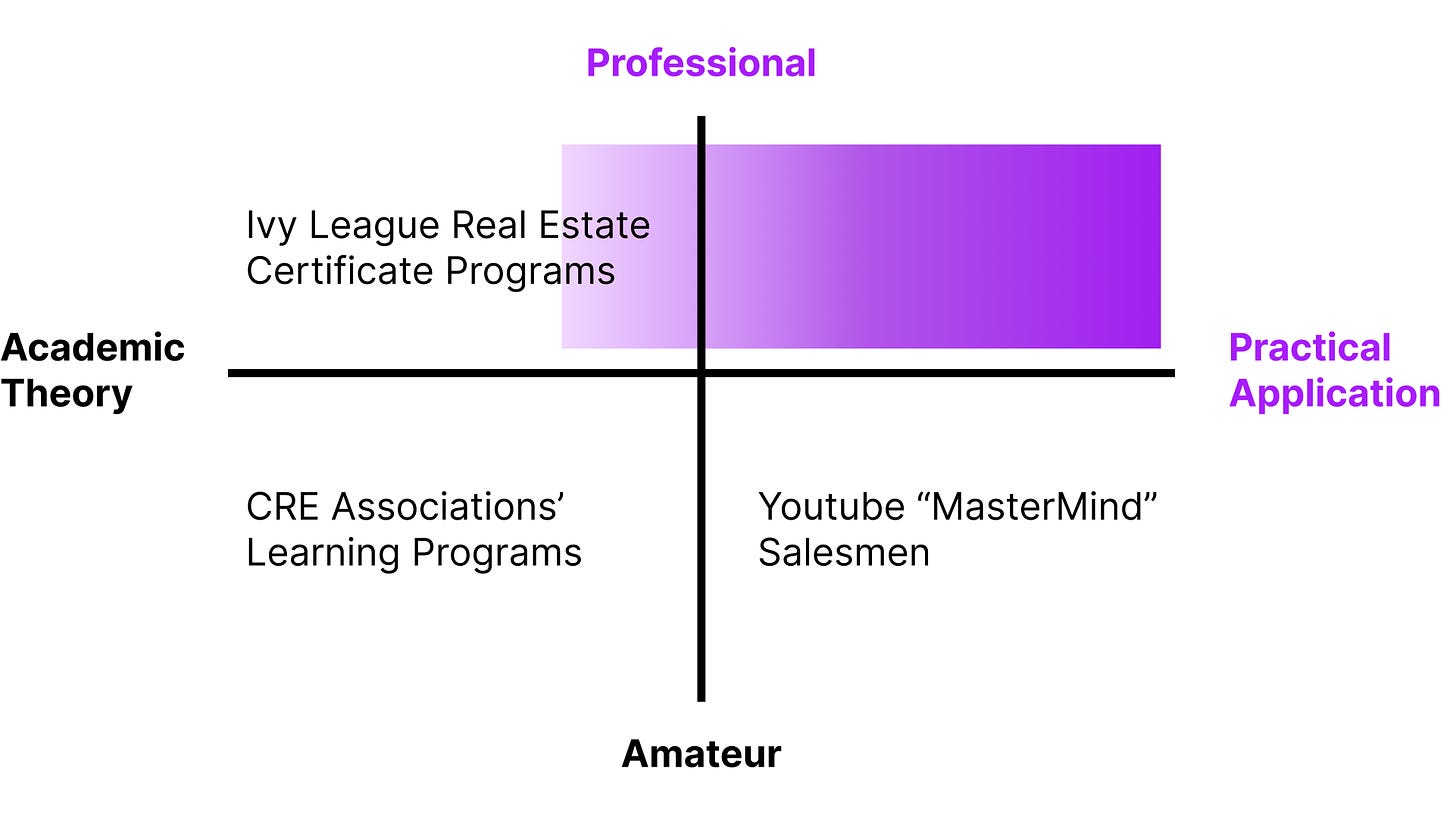

It has now been six months since Thesis Driven’s first Fundamentals of Commercial Real Estate course in NYC. We started offering these courses because we saw a clear need in the market: professional education that can be practically & immediately applied to a real estate career.

Since our first live, in-person program in March, we’ve now hosted three live courses (with a combined NPS of 73!) and are hosting our fourth program on August 7th and 8th in NYC.

These live courses—and the students who participated—have provided us with a ton of learnings thus far. Here are the top six lessons:

1. Real estate finance is simple–but not obvious

There are lots of really smart people in technology roles and companies serving the real estate industry who don't understand basic real estate math. This is a problem, as a lack of understanding of real estate fundamentals makes it harder for companies and service providers to build the products that real estate operators and investors really need.

But learning the basics of real estate math isn’t as challenging as many think it will be. Once students learn to calculate a few key metrics, like unlevered yield on cost (UYOC) and internal rate of return (IRR), light bulbs go off and students fundamentally understand what makes real estate investors and developers tick.

And by understanding who gets paid what—and why—in a transaction, students get a better sense of how to sell to / market to / build for the different stakeholders. We teach this through by following a specific project through the entire process of sourcing, underwriting, acquisition, redevelopment, lease-up, stabilization, and sale. And we get to know the characters involved in the process along the way. (You can meet them here.)

2. Cohorted learning > Individual learning

We are big believers in the benefits of live, cohorted learning groups tackling a topic together. Not only do students benefit from direct interaction with instructors and fellow students, but the camaraderie of tackling a topic alongside other learners is a huge benefit.

“The course is really dynamic because people with different backgrounds are asking questions and facilitating conversations, creating layers of additional learning on top of the course materials,” said one student.

And over a third of our students have said the networking opportunities ended up being as important as the course itself. As we’ll discuss below, the courses end up being filled with people from a wide range of perspectives and backgrounds.

3. This isn't just for "tech bros"

When we built the first Fundamentals course, we anticipated the majority of our students would be coming from the proptech industry. But we ended up bringing in a much wider audience, including:

GMs and regional directors of brick and mortar businesses,

In-house innovation teams at large CRE firms,

Emerging sponsors, and

Other CRE service providers (e.g., architects and lawyers)

… in addition to our intended audience of proptech employees—especially sales & marketing roles.

We’re also finding there are core fundamentals everyone working in CRE should know, and then opportunities to teach more specialized skills to specific stakeholders.

4. Some students have to unlearn a venture / operating background

We’ve found that many students with experience running venture-backed operating companies find it harder to grok real estate finance than those without any finance background whatsoever. Unfortunately, making the jump from venture math to real estate math requires unlearning a lot of what one knows about how finance works.

Often, VC-familiar students want to view the real estate GP as an entrepreneur and the real estate LPs as venture investors. But this analogy causes more misunderstandings than it solves. If anything, real estate GPs are more analogous to VCs—and assets to startups—than they are to VC-backed entrepreneurs. But even that isn’t a perfect comparison, as VCs also almost exclusively work through funds, whereas many real estate transactions happen deal-by-deal.

Venture investors also tend to have less variety in their business plans than do real estate investors. Most VCs need to return capital in 7-10 years, while real estate investors’ target hold periods could range from 18 months to forever. Understanding the variety of real estate investment business plans—and how they all roll back to the same fundamental return math—is essential.

In short, most students are better off leaving their venture analogies at the door and starting from scratch when learning real estate finance.

5. Talk to every applicant

After our first course, we tried to onboard applicants without speaking to them first. This was a mistake.

Now, we speak to every applicant, usually within a day or two of the application coming in. Understanding each student’s goals—and the level of real estate experience they have going in—is key to making a connection with the student as well as ensuring the course is at the right level for the student. I’ve told more than a few students that they shouldn’t take the course, typically because they’re too advanced. That’s the last thing we want.

Understanding students’ goals directly also helps us continuously improve the material and make sure we’re hitting all the key points in the right way. Learning that we had a number of students learning real estate with the goal of eventually taking over their family real estate businesses, for example, helped us broaden our in-class examples beyond just real estate private equity deals.

6. Practical application matters

We believe most students today are seeking hard & soft skills to enhance careers over educational theory.

By focusing the course around fictional case studies and tangible projects and characters, students are able to empathize with stakeholders across the ecosystem–and then form their own connections on how this can be applied to their careers.

And we finish with a capstone project, allowing students to creatively apply everything they’ve learned to a new project’s business plan (a much different “final assessment” than Ivy League CRE certificate programs).

What's Next?

Our next Fundamentals of Commercial Real Estate cohort is August 7-8th live in NYC and you can sign up here.

And our next Fundamentals of Capital Raising course will launch at the end of Summer. The dates are still TBD but you can join the waitlist here.

We’re excited to continue building this educational community for your specific needs, so if you’d like to weigh in on themes and topics you’d like to see us tackle in the future, we welcome feedback here!.

—Brad and Paul