We published more than a hundred Thesis Driven letters in 2024, not counting those promoting our courses or database. At an average of 2,000 words per letter, that’s 200,000 words—enough to easily fill two full-length novels.

It’s okay if you didn’t read every single one of them. We get it.

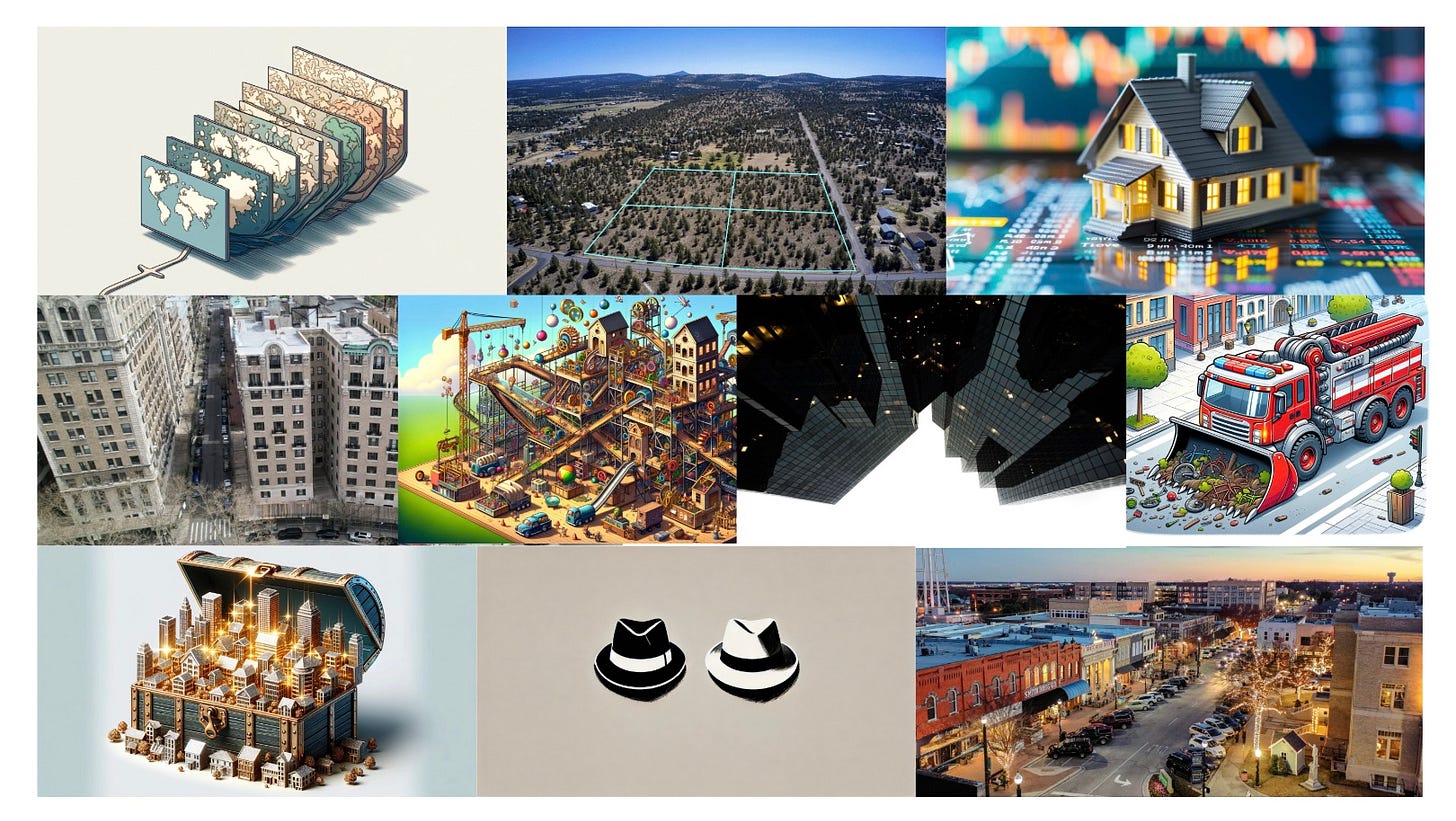

So we’re taking a moment to highlight the ten letters from 2024 that you absolutely shouldn’t miss. Today we’ll share a bit about how each of them influenced our thinking about 2024 as well as the year to come.

Let’s dive in:

10. The Business of Land Subdivision

Land subdivision is unlike any other category of real estate. Mainstay metrics like IRR are nonsensical, and GPs might spend as much on deal sourcing and evaluation as they do on the assets themselves. Operating businesses masquerading as asset managers, land subdivision and development companies are among the most fascinating and lucrative firms in real estate.

This letter dug into some of the best in the business and continues to stick with me today.

9. Lookalike Modeling in Real Estate

I always try to draw parallels between the trends and phenomena happening in real estate and those in other industries. So I was intrigued when I saw i360 release a data product that borrowed a mainstay from the digital marketing world: lookalike modeling. I used their tool to find comparable neighborhoods across the US and ended with some thoughts on the emerging capabilities of real estate data analysis and what we might see in 3-5 years.

8. How to Work with Family Offices.

As they say, if you’ve met one family office, you’ve met one family office.

But that doesn’t mean we can’t make some generalizations about working with them, including some best practices of building family office relationships and working with them as investors. And in the current market, family offices are playing an increasingly important role in funding real estate deals, including innovative concepts. This letter dives deep into the world of family offices through interviews with several firms of various sizes and types.

7. The Institutionalization of Home Equity.

Hunter Hopcroft dives into the world of Home Equity Agreements (HEAs), rising stars in the world of real estate financial innovations. Over the past 18 months, companies offering HEAs like Point and Unison have won institutional interest in these upside-sharing arrangements that can help homeowners access their equity without monthly payments.

6. Trust and the Future of Multifamily Fraud

Becoming far more common—and sophisticated—in recent years, application fraud is now one of the biggest issues in multifamily management. But it’s ultimately downstream of broader societal changes that are taking place; specifically, decreasing social trust in the United States.

I write about a new company in the multifamily fraud space—100, which is creating a pre-vetted renter network—through the lens of these social changes and how they might impact the multifamily industry in years to come.

5. How to Make a New Asset Class

The past decade has seen the emergence of numerous “new” asset classes from single-family rental to STR to data centers and self-storage, each of which emerged from the fringes of real estate to reach the institutional mainstream. For real estate operators, riding this tide of growing institutional interest and cap rate compression is a surefire way to make real money.

For each sector, their paths to institutionalization shared some similar traits and steps. This letter attempts to deconstruct what it means to “make a new asset class” with some lessons on where things can go wrong along the way.

4. In Search of the Walkable Exurban Downtown

Post-pandemic urbanism is a contradiction. On one hand, people want more space and a yard. On the other hand, people desire walkability and freedom from total car dependence. In most cases, those are incompatible needs. But there is one place at the center of the Venn diagram: the Walkable Exurban Downtown (WED), which has seen the highest population growth rates of the post-pandemic era and continues to shine as Americans simultaneously seek space and quaint walkability.

So what is a WED? How do we find them, and can we build more?

3. Making the Leap to Long-Term Holding

The greatest real estate fortunes are made not by flipping deals but by holding great assets over decades if not generations. But for upstart real estate operators—who need fees to eat and must exit to hit their promote—it’s not obvious how to reorient a real estate business to hold assets generationally.

This letter explores that question with Moses Kagan, veteran real estate operator and co-founder of ReSeed. We look at all the elements—structural, financial, and cultural—that real estate operators must transform to begin building for the long haul.

2.The Sad Tale of NYC’s Rent Stabilized Housing

In 2019, the New York State legislature passed a set of landmark reforms to the state’s rent stabilization program. Through those reforms, the state embraced vacancy control, which means rent stabilized units’ rent could not reset to market upon tenant turnover. Furthermore, owners were only allowed small rent increases to compensate for renovations of units that had often been occupied by individual tenants for many decades.

The end result is a growing number of vacant rent-stabilized units and severe distress in New York’s rent stabilized housing market—enough to sink one lender already and push others to the brink. This letter tells the story of New York’s rent stabilized housing program, the crisis on the horizon, and what (still) isn’t being done to fix it.

1. On Fire Departments

This was my most popular—and controversial—letter of the year. Fire departments, for all the good they do, have become net negative contributors to well-being. A powerful lobbying force for bad urban design, fire departments are preventing us from building the kind of communities humans need even as actual fire deaths decline to a vanishingly small number due to advances like sprinklers, fire alarms, and fire-rated materials.

Of course, any criticism of our our working-class heroes will cause a stir, and this letter did not disappoint.

Want to read these and more to come in 2025? Please join us as a subscriber!

—Brad Hargreaves