Thesis Driven’s case-based course, Fundamentals of Commercial Real Estate, provides proptech (and other companies selling into the CRE industry) unique insights into key stakeholders in the CRE ecosystem—and the problems they face in the current market landscape.

Today’s letter explores how sales, marketing and product leaders can better empathize with the challenges landlord clients face by breaking down–in simple terms–what’s happening in CRE today.

The next Fundamentals of Commercial Real Estate cohort is launching online October 28th. Sign up here.

Selling into the commercial real estate industry was a dream in 2020 and 2021.

Landlords all seemed eager to add new technologies and services to their portfolios. The largest owners were forming in-house innovation teams dedicated to navigating these solutions. And VCs were dumping in record amounts of cash to fuel the fire.

But then, as quickly as it started, the party ended. Interest rates went up, loans came due, and the negative impacts of remote work and AI became clear. As the clock struck twelve, landlords turned from real estate innovators back into capital markets jockeys.

But what does that actually mean for proptech companies? Why have many turned away from innovation, and how do you sell to them now?

Let’s start with what’s happened since 2020

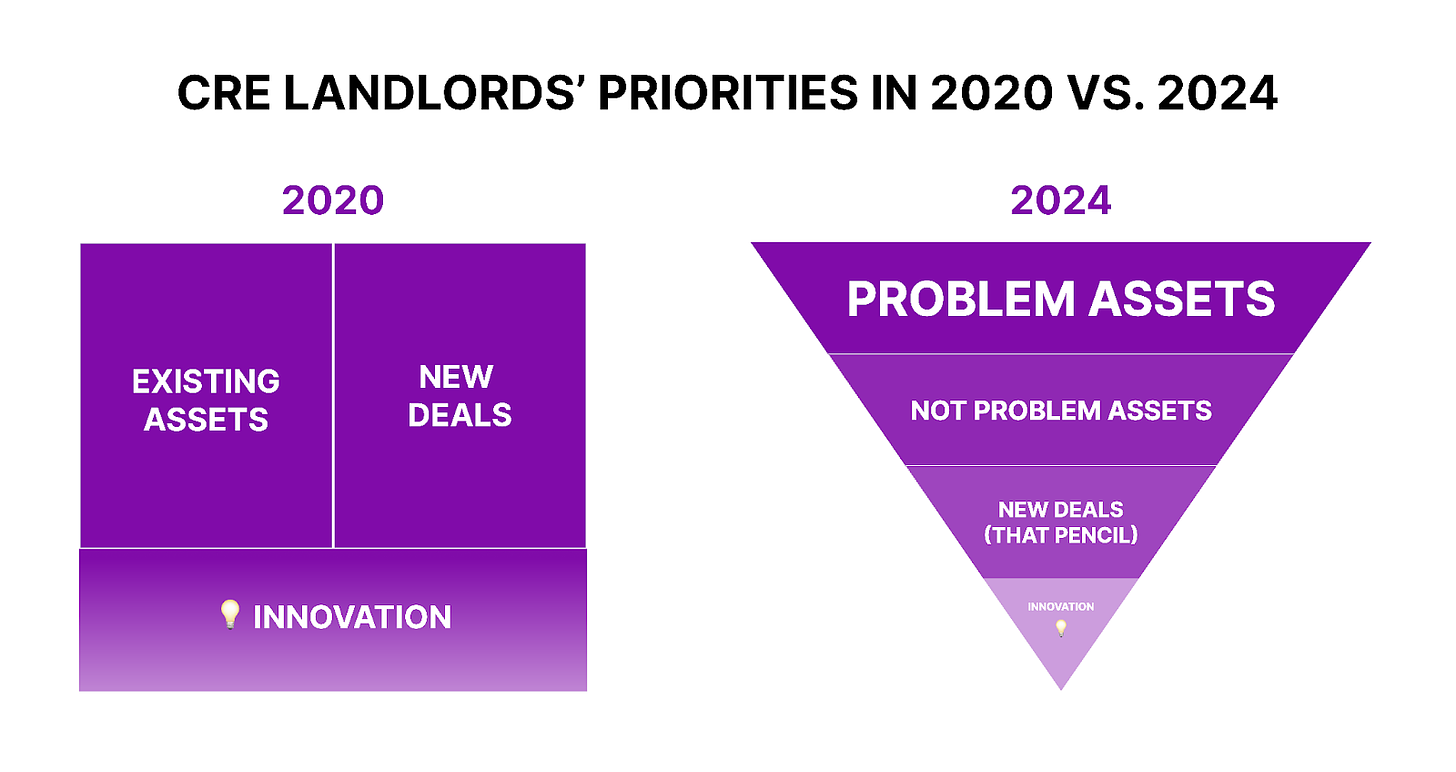

The shift in CRE landlords’ priorities can be summarized as follows:

2020

Landlords had access to cheap debt (because interest rates were low) and supply-demand was relatively balanced across most CRE asset classes.

So landlords felt safe. They knew there was a large market of buyers who could afford their properties if/when they decided to sell (because those buyers could get cheap debt). And if they didn’t sell, but needed to pay off a loan, they knew they could refinance their project (with cheap debt).

This peace of mind freed them to explore new opportunities, like new operating models (e.g., coworking, coliving, and short-term rentals) and technology solutions (e.g., data insights, automations, and enhanced tenant experiences).

2024

Interest rates spiked dramatically in 2022 and have yet to come back down.. This has made debt more expensive, which means the market of buyers for landlords’ properties shrunk because buyers couldn’t get cheap enough debt to make the deal pencil.

But more importantly, many landlords now have to pay off their existing loans on their buildings (these are typically 5 year loans) and can’t refinance (again, because the debt options available to them are too expensive). So if they can’t pay off their loans on time, they go into default and risk losing their buildings to the banks.

This is what is happening across the market currently for landlords. They are:

Scrambling to negotiate loan extensions with the banks for the problem assets; while

Trying to be sure their non-problematic assets don’t become problems; while

Trying to find new deals to buy, but can’t, because the cost of debt is too high to justify the sale prices (which sellers need to keep high to pay off their own loans!)

And this is why they can’t focus on innovation, and instead must be capital markets jockeys, i.e., riding the ups and downs of the market turmoil driven by high interest rates.

What’s coming in 2025 and beyond

The Federal Reserve or “the Fed” (who dictates whether interest rates go up or down) announced the first drop in interest rates in over two years just last month. But last week’s jobs report was stronger than expected, which means interest rates will likely stay higher for longer. Since then, the 10 year treasury has actually risen back above 4% - higher than it was prior to the recent rate cut.

So landlords could be in a tough spot—working out problem assets while struggling to buy new ones—well into 2025.

How do proptech companies sell in this tough market?

Empathy.

Proptech companies today cannot sell the same way they sold in 2020 and 2021. They have to understand key stakeholders’ pain points and speak to solutions that make an impact in the current environment.

This requires real work on the part of sales, marketing and product teams to get closer to their customer personas and understand their evolving roles and what’s driving the decision-making of key stakeholders today, specifically:

Managing Partners

Managing partners are focused on the survival of their portfolios, navigating the challenges of refinancing, and avoiding defaults. With interest rates high, they’re grappling with securing new financing at reasonable terms and keeping their investors satisfied in a market where liquidity is scarce. New investments and innovation are on hold as they focus on solving these immediate capital problems.

Asset Managers

Asset managers are in crisis mode, closely monitoring cash flows to ensure debt service payments and other obligations are met. They’re under immense pressure to maximize asset performance, cutting costs wherever possible while improving NOI. At the same time, they’re dealing with tenant retention challenges in sectors like office, where demand is still weakened by remote work trends.

Property Managers

With budgets tightened and operating expenses rising, property managers are struggling to maintain service levels. They’re trying to keep tenants happy while dealing with increasing costs for labor, materials, and services, all while landlords push them to cut costs. Deferred maintenance is becoming more common, leading to longer-term property degradation.

Leasing Agents

Leasing agents are faced with a stagnant or declining demand in many asset classes, particularly in office and retail. They’re under pressure to attract tenants in a tough market, where companies are hesitant to sign long-term leases. Concessions, flexible leasing terms, and aggressive marketing are now part of their daily operations.

Lenders

Lenders are tightening credit standards, making it harder for landlords to refinance existing debt. Many lenders are concerned about their exposure to distressed assets and are focused on managing risk rather than extending new loans. They’re negotiating loan extensions but are also raising interest rates, creating friction in the process.

Equity Investors

Equity investors, especially institutional ones, are in a wait-and-see mode, reluctant to commit capital while market conditions are volatile. They’re concerned about valuations, especially in office and retail, and are focused on identifying distressed opportunities where they can get assets at a discount. However, their patience is wearing thin, and they want to see how current portfolios will perform before making new bets.

By understanding these pain points, proptech companies and their executives can begin designing sales campaigns, messaging, and features that meet the needs of the ecosystem today–not the ecosystem of 2021.

A case-based understanding of the commercial real estate ecosystem and its key stakeholders is a crucial part of our Fundamentals of Commercial Real Estate course.

Whether you’re selling into this space or just looking to deepen your understanding of it, join us for our next cohort, launching October 28th. Sign up here!

—Paul Stanton