Video: Welcome to Reindustrialize! (youtube.com)

Taking the long view, the world of commercial real estate is driven by mega-trends. Our economy evolves and paradigms shift in ways that dramatically impact how we develop and relate to our built environment. Online shopping changed our relationship to retail and industrial space. Software, cloud storage, and eventually, a pandemic changed our relationship with the office.

While those paradigm shifts are well understood, a larger, more complex mega-trend is beginning to have a major influence on real estate and where growth in the coming decades will cluster.

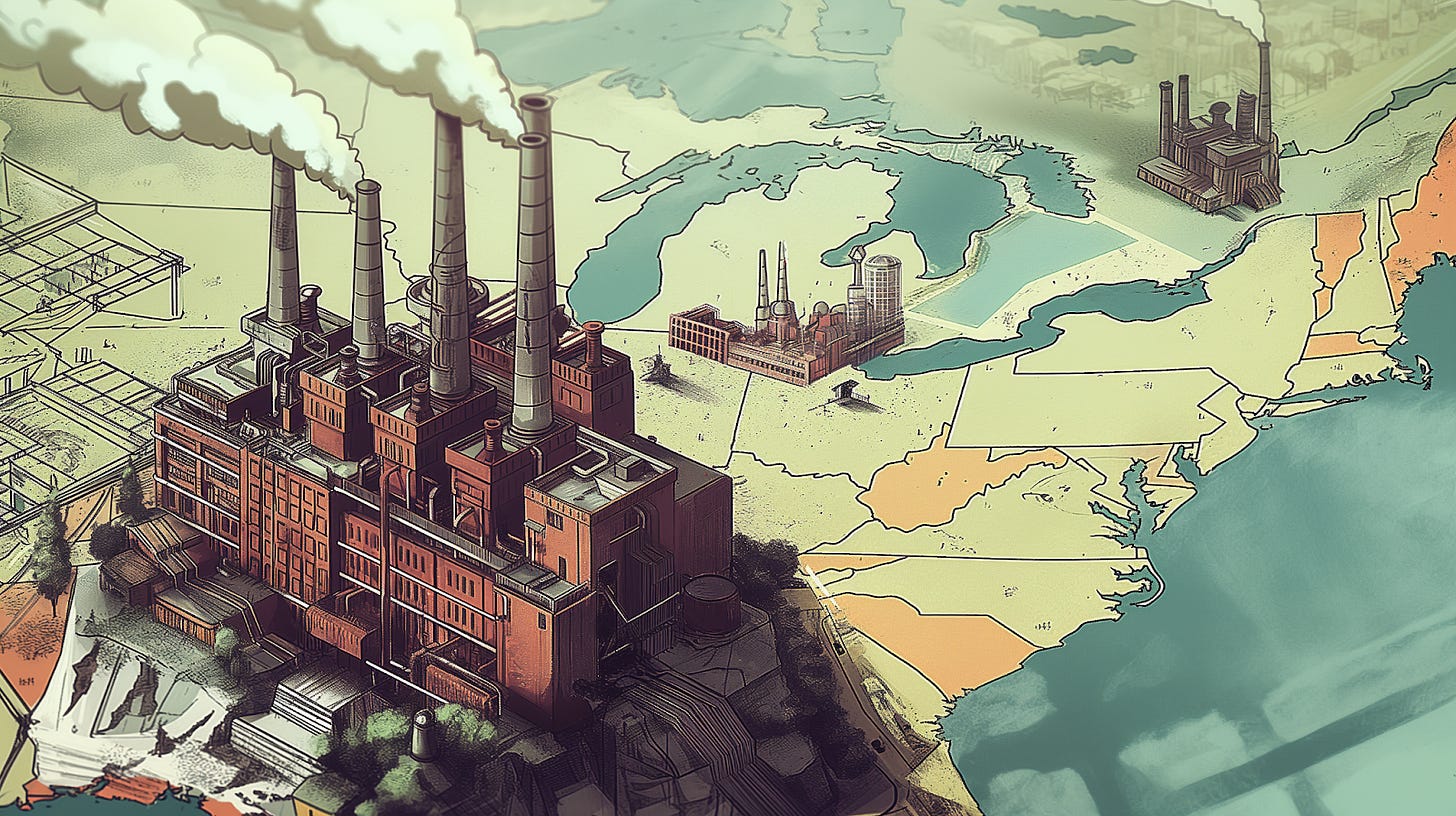

Reindustrialization, reshoring, and nearshoring are poised to alter the future of real estate dramatically. The en-vogue geographies, asset types, and demographics of the past will no longer provide reliable signals about the future. Politicians, developers, and investors will need to think differently about real estate in an economy that aims to look more like 1974 than 2024.

In today’s letter, we will explore how real estate investors should adapt their models and respond to these changing trends, including:

An overview of policy trends shaping the reindustrialized economy

The challenges and opportunities in developing domestic advanced manufacturing

The rising importance of workforce development

How transportation networks are evolving to accommodate new trade patterns

Regulatory headwinds that are constraining growth

The knock-on effects of industrial development for legacy maintenance providers and the requisite real estate.