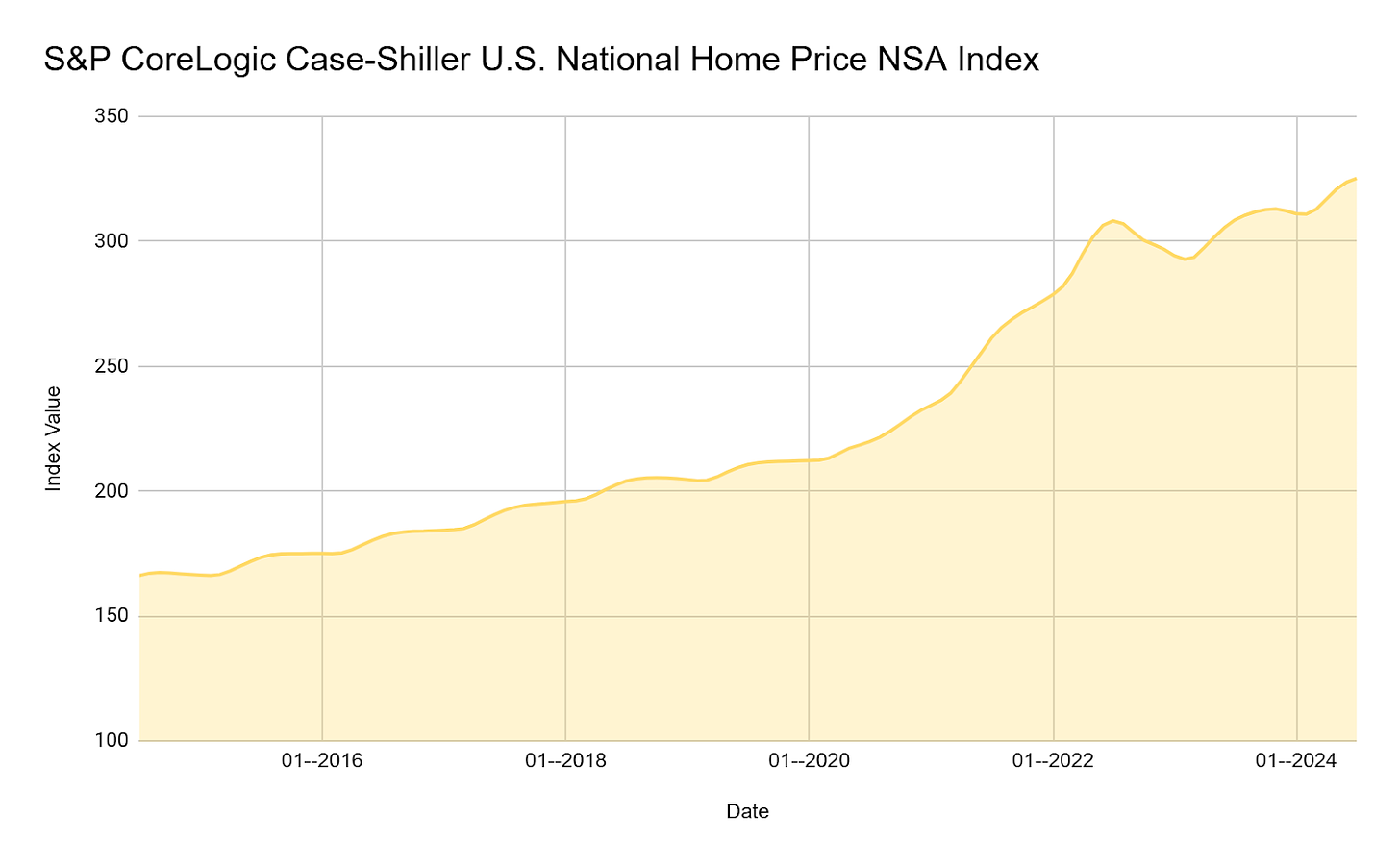

Despite a near-constant chorus of “Bubble!” from housing bears, the case for structurally higher home prices has remained unchanged for the past decade. Limited supply growth and declining affordability have increased home prices through business and credit cycles.

Such consistent performance has unsurprisingly attracted investment capital. In addition to outright institutional ownership of rental homes, the desire to somehow fractionalize or securitize exposure to residential price appreciation has spawned countless start-ups and structures. Jeff Bezos-backed Arrived, the perenially dogged Divvy, and double-unicorn Roofstock have all tried to streamline and distribute various forms of passive investment in residential homes. Nearly all have struggled despite the macro tailwinds for residential pricing. Coverage of VC-backed Landa highlighted the myriad inherent challenges of “democratizing” residential investing.

Meanwhile, the Home Equity Agreements (HEAs) market has quietly thrived. In recent years, substantial expansion in the HEA market has been driven partly by rising interest rates that have made traditional refinancing less attractive to many homeowners. A March 2024 TransUnion publication underscores the market's potential, which estimated a staggering $22.1 trillion in tappable home equity across 86 million U.S. consumers. This vast pool of untapped equity represents a significant opportunity for continued growth in the HEA market.

The market has evolved through stages of institutionalization towards becoming a distinct asset class. Just last week, private equity firm Carlyle announced an investment in HEA pioneer Unison and a commitment to purchase $300 million of newly issued equity-sharing agreements from the firm. Today’s letter will take a look at:

The history and growth of the HEA market

Nuances within various HEA contracts

How capital markets are developing for these assets

Potential future innovation around home equity investments

Companies Discussed: