The State of Modern Tenant Screening

Combatting the fraud epidemic and what to expect from best-in-class tools

Jaymie Fung Bingham and Aaron Ru are investors at RET Ventures, an early-stage real estate technology venture capital fund backed by ~60+ institutional owners and operators of real estate

The process of tenant screening—verifying an applicant’s identity, income, credit, and background—has become more critical and more challenging than ever. Today, rental housing owners and operators face a surge in application fraud and new regulatory pressures that simply didn’t exist even half a decade ago. Recent surveys show that over 93% of property managers encountered some form of rental application fraud in the past year, a shocking 40% year-over-year increase.

Fraudulent applicants are increasingly tech-savvy and organized, exploiting gaps in traditional screening. Even for operators who have adopted point solutions for the various aspects of the screening and verification process, the fact that these systems frequently don’t talk to each other and don’t engage in compounding fraud checks throughout the process can lead to “bad actors” slipping through.

Screening providers are calling this the “Frankenstack” Failure. When screening relies on siloed tools for ID verification, credit checks, and document validation, gaps open up that delay approval, or worse, allow fraud to slip through unnoticed. For example fraudster using a stolen identity might successfully pass each step in isolation: a realistic-looking fake ID, a clean credit report belonging to someone else, and doctored pay stubs But because the systems don’t talk to each other, and don’t cross-reference data points, there’s no holistic fraud signal and no one catches that the pieces don’t actually belong to the same person.

The consequences can be severe: higher eviction rates, lost rent, property damage, legal liability, and harm to a community's reputation. At the same time, governments are enacting stricter laws around tenant screening, from “Fair Chance” laws banning criminal background checks to data privacy and Fair Credit Reporting Act (FCRA) enforcement, adding unprecedented complexity to compliance. In addition, the fine print of the most common providers of criminal background checks indicates that “national” coverage rarely covers all 50 states and often utilizes stale criminal data that has not been updated for over a decade.

At RET Ventures, we work closely with our strategic investors to identify the most pressing pain points in their organization, and over the past few years, they have indicated that fraud has become an ever-increasing problem and challenge to navigate. This understanding drove our early investment in Rent Butter; the company has a clear vision for building a full-stack screening and verification platform designed to equip operators with the right data to make smarter, more confident leasing decisions. Alongside looking for full-stack solutions, we continue to see operators adapt to this new environment by pushing for more centralized screening functions to keep the expertise of screening to a trained team and make it simpler to deploy the right technology stack. In short, modern tenant screening matters now because the stakes (financial, legal, and operational) have never been higher.

This article will go in-depth on:

The Downstream Costs of Poor Tenant Screening

The Rise of Rental Application Fraud And AI-Generated Fraudulent Documents

Growing Regulatory Complexity in Tenant Screening

A Deeper Dive into Criminal Record Screening and Liability Concerns

And What To Expect From a Best-In-Class Tenant Screening Solution

The Downstream Costs of Poor Tenant Screening

Inadequate tenant screening can lead to significant financial and operational consequences. The most immediate cost is eviction, which averages $20,000 - $25,000 per case.

Fraudulent applications are a major driver of these losses. A recent survey found that nearly 24% of eviction filings over the past three years were linked to tenants who submitted fraudulent applications. Property owners reported an average of $4.2 million in bad debt write-offs over a 12-month period, with about 25% of those losses attributed directly to rental application fraud.

These are not just accounting line items; they have real operational impacts. Landlords facing fraud must deal with unexpected vacancies, turnover costs, and staff time spent on collections and legal processes. For institutional operators, the price of poor screening can quickly exceed the cost of robust verification processes.

The Rise of Rental Application Fraud And AI-Generated Fraudulent Documents

Several converging trends are driving a dramatic rise in rental fraud, including rising economic stress, digital tools, and artificial intelligence that make deception easier than ever. During the pandemic, some operators saw fraud rates nearly double, and although that initial spike has cooled, fraud remains elevated in 2024 and is expected to rise further in 2025. The industry is experiencing fraud that is now more organized, harder to detect, and often involves fake identities and fabricated income.

Social media platforms like TikTok and Instagram have also fueled a proliferation of how-to guides and fake document sellers. The result: fraud rings exploiting weaknesses in traditional screening processes. Property Shield, a cybersecurity company specializing in protecting real estate owners and operators from listings fraud, has identified that many of these fraud rings are now multinational and highly coordinated via the dark web; today they see $16.0b of estimated annual losses due to rental fraud. Alexander Fahsel, CEO at Property Shield says “'Crime syndicates behind this type of fraud are quickly adopting AI and large language models, making these scams more common and highly sophisticated.”

Nearly all operators now rank fraud prevention as a top priority, and 92% believe technology is essential to stay ahead.[1] Today’s screening systems must assume any document or identity could be fake, and be built to verify accordingly and perform rigorous compounding fraud checks.

As if human fraudsters weren’t enough, operators now must contend with artificial intelligence being used to dupe their screening processes. Generative AI has reached a level of sophistication where it can produce extremely realistic fake documents and identities with ease. For example, AI image generators can fabricate a perfect bank statement or paystub that shows a consistent payment history and correct math, with none of the obvious errors that used to give away forgeries. With a simple text prompt, a determined applicant could synthesize a fake mobile banking screenshot showing 12 months of on-time rent payments, matching the format of a real banking app – a task that once required advanced Photoshop skills. AI models can also churn out fake employment verification letters or landlord reference letters that read professionally and consistently.

The result is that fraud is now harder to detect by eye, and many traditional software checks can be fooled. For instance, a basic PDF metadata check might not catch an AI-generated image of a document. Likewise, database cross-checks might verify that the employer exists and that the bank account format is valid, yet the content itself is fictitious.

The proliferation of AI-generated documents means property owners must be more vigilant than ever. It underscores the need for multi-factor verification and compounding fraud checks – such as requiring direct-source data (like pulling income data straight from a bank or payroll provider) and live identity checks (like selfie verifications) to corroborate any uploaded documents. In short, AI is a double-edged sword: it can greatly enhance screening efficiency, but in the wrong hands it can also supercharge fraud.

Growing Regulatory Complexity in Tenant Screening

Navigating tenant screening today isn’t just about fighting fraud – it’s also about complying with a rapidly expanding web of regulations. Federal, state, and local governments have introduced a slew of “tenant screening protection” laws aimed at promoting fairness and accuracy, which in turn increase compliance burdens on landlords and screening companies.

One major area of new regulation is criminal background checks. Cities like Seattle and New York City have effectively banned most criminal background checks for housing. New York’s Fair Chance for Housing Act (Local Law 24), passed in 2023, took effect January 1, 2025, and prohibits New York City landlords and brokers from considering most criminal records in tenant screening. Under this law, housing providers will have “limited ability” to use criminal history, essentially barring automatic rejections for past convictions and requiring an individualized assessment if a “reviewable” record appears. Many other jurisdictions have implemented “ban-the-box” style laws or shorter “look-back” periods. This means screening processes must be adaptable by location – what is allowed in one city (e.g. a felony check) might be illegal in another. Failing to comply can lead to hefty fines or lawsuits for discrimination.

Eviction history and credit checks are also seeing new limits. Recognizing that eviction records can be misleading or perpetuate housing insecurity, over a dozen states and cities have enacted eviction sealing or screening restriction laws in recent years. For instance, California automatically seals eviction filings that don’t result in a judgment within 60 days. Other places prohibit rejecting an applicant solely due to a past eviction or poor credit score. Some cities (like Oakland, CA and Philadelphia, PA) bar the use of eviction records older than a certain number of years.

Meanwhile, data privacy and consumer protection regulations are tightening around the technology used in screening. The Fair Credit Reporting Act (FCRA) has long governed tenant screening reports, but enforcement is on the rise. In 2023, the U.S. CFPB and FTC jointly signaled a crackdown on tenant screening inaccuracies and abuses as part of the White House’s “Blueprint for a Renters Bill of Rights.” They issued requests for information on screening’s impact and HUD released guidance on applying the Fair Housing Act to tenant screening algorithms. Federal regulators have not hesitated to act: TransUnion was fined $15 million by the FTC in 2022 for failing to ensure accurate tenant background data. Screening providers also face new state AI bias laws that restrict “automated decision-making” if it leads to discriminatory outcomes. All of this means that both the software and the landlord must handle applicant data with greater care – ensuring reports are up to date, verified, and used consistently.

In sum, tenant screening now operates under a patchwork of legal frameworks. Owners and operators (especially those operating across multiple states) need a modern screening platform that tracks adjustments to local laws and maintains compliance. In the next section, we delve deeper into one of the most challenging regulatory areas – the use of criminal records – and the liability it creates for housing providers if handled improperly.

A Deeper Dive into Criminal Record Screening and Liability Concerns

Criminal background checks have long been a standard part of tenant screening, but they have become a legal minefield. On one side, landlords fear liability if they rent to someone with a serious criminal history who then harms other residents. On the other side, rejecting applicants because of their criminal record can lead to claims of discrimination or the use of inaccurate data tied to individuals with similar names, addresses, etc.. Striking the right balance has proven difficult and resulted in lawsuits like the Transunion suit mentioned above, and as a result, providers are becoming far more cautious in how they handle criminal records.

Many have shifted to a “data-only” approach: instead of issuing a pass/fail decision based on a criminal hit, they now simply deliver the raw record data to the screening provider or landlord and let the landlord make the judgment. By not making an automated recommendation, the screening company or data provider reduces its liability and is “only reporting publicly available information” (as allowed under FCRA). The burden then falls on the property manager to interpret the record and ensure compliance with the laws.

Some providers have gone even further – no longer automatically matching records to applicants without additional checks. For example, if a criminal database shows a record for John Smith, the service might not automatically flag it to a John Smith applicant unless identifiers match perfectly; instead, they might ask the landlord to verify the applicant’s identity details to confirm it’s the same person. This is to prevent false positives (e.g. mixing up two people with the same name) which previously led to lawsuits. Essentially, the screening services are trying to shift more responsibility (and risk) back to landlords in the criminal check process.

For institutional owners and operators, this means more diligence is required on their part – they can no longer rely on a red light/green light from the screening report. They may need to double-check any criminal records, ensure they’re following any local fair-chance laws, and document their decision-making rationale in case it’s ever challenged. For large operators, this has furthered the case for centralizing the screening function within their organizations to make sure that standards are implemented consistently to make sure that mistakes are not made here is critical. This shift in combination with a screening solution that has automated real-time adjustments for compliance by jurisdiction, will minimize an operator’s risk.

In combination with this, most screening services use off-the-rack and unvetted data sources. When a provider offers a “national instant” search, read the fine print. National instant searches almost always only cover 26 states fully, with another 12 states having incomplete databases (only up to a certain year). This means that to have a true “national” search, owners and operators need a solution that will perform county-level searches in the remaining 24 states.

For example, Rent Butter offers a screening and verification platform that includes a true national-level criminal background check feature. Rent Butter’s screening solution does a full skip trace on the applicant, immediately pulling all counties in which the individual has lived, and makes it easy to configure a criminal record search plan that gives the operator cost control, as well as confidence that the automated criminal screening complies with each jurisdiction’s complex local, state, and federal regulations and with the FCRA.

The bottom line is that owners and operators should choose screening partners who not only provide thorough and true nationwide criminal searches (including alias and county-level checks) but also help with compliance – such as built-in adverse action letters and documentation that the operator considered relevant factors (nature of crime, time elapsed, rehabilitation evidence, etc.). In summary, criminal record screening must be handled with precision and care. It’s a necessary tool for safety, but if done incorrectly, it opens the door to legal and financial fallout. The best practice is to integrate criminal checks as one piece of a holistic screening process, backed by up-to-date data and clear policies that meet the latest legal standards.

What To Expect From a Best-In-Class Tenant Screening Solution

Given the high stakes described above, it’s no surprise that what landlords and investors expect from screening technology has evolved significantly. The days of simple credit checks and basic background reports are over. Modern property owners—especially institutional investors and tech-forward operator—now demand comprehensive, fraud-resistant, and user-friendly screening solutions.

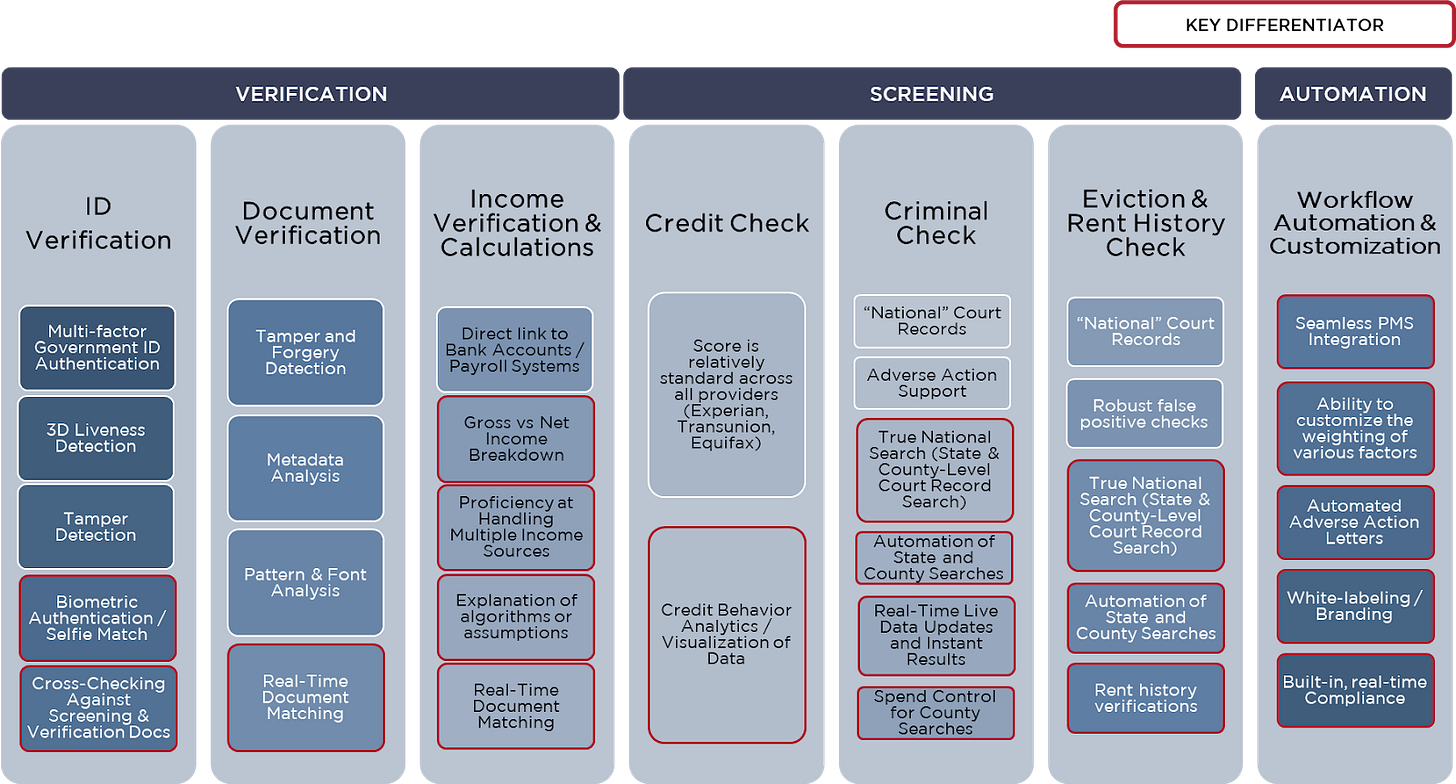

In practical terms, this means a shift from legacy screening systems (often just an add-on module in property management software) to next-generation platforms with a set of best-in-class features that offer end-to-end verification, screening, and workflow automation.

One-Stop Shop: RET recently interviewed strategic investors across the multifamily and single-family sectors to understand their priorities when evaluating screening solutions. The feedback was clear: there’s growing fatigue with fragmented point solutions. Operators are frustrated by the inefficiencies and gaps that come from stitching together separate tools for screening, ID verification, and document verification. What they want now is a unified solution that does it all—and does it well. If minimizing fraud is the goal, the tools must work seamlessly together and compound fraud checks. Otherwise, the process leaves critical vulnerabilities exposed.

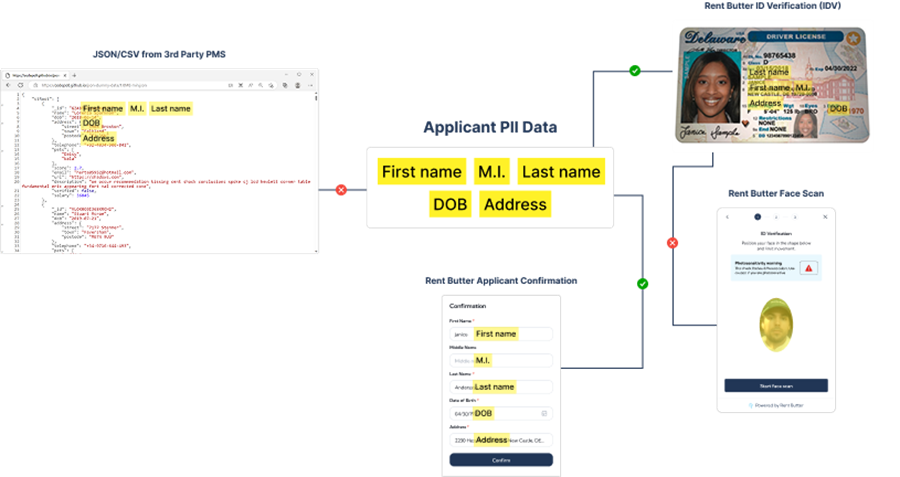

Identity Verification Built In: Owners expect that a screening process will actually verify the person’s identity AND match this information to the rest of the information obtained in the screening process. This involves multi-factor ID checks—for example, scanning government ID documents and ensuring they are legitimate, comparing a selfie or live photo of the applicant to the ID, and cross-checking identity details against databases. Best-in-class systems now incorporate 3D liveness detection (to prevent someone from using a photo of a photo) and biometric matching to confirm the applicant is real and the same person on the ID. This is a leap from older systems that might have only asked knowledge-based questions (“out-of-wallet” questions) or done a basic SSN trace.

Direct-Source Income Verification: Before moving into document verification, screening providers should encourage applicants to utilize the integrations with banking and payroll systems that allow for direct verification of income and employment. Rather than just trusting documents from the applicant, best-in-class systems will connect directly to financial data sources with the applicant’s permission. Solutions with multiple API integrations with payroll providers (e.g. Pinwheel, The Work Number, ADP) or open banking data feeds (Plaid, Yodlee, etc.) to pull bank account transactions enable the highest level of engagement by giving prospective residents as many choices as possible.

Direct data improves accuracy: By ingesting actual deposit history and salary info straight from the source, the screening process can more accurately assess an applicant’s ability to pay rent and catch inconsistencies (for instance, if someone claims $6,000/month income but their bank records show far less).

“Waterfall” approach to verification: The expectation now is that a solid screening platform offers a “waterfall” approach to income verification: try automated data sources first (for speed and accuracy), and if those fail or are incomplete, then default to manual document upload with fraud scanning.

Transparency in income calculations: Another evolved expectation is transparency in how income is calculated. Many providers and legacy systems often make opaque calculations (some simply output an “income exceeds 3x rent: yes/no” without detail), whereas now owners want to see the assumptions or calculations. For example, does the system count bonus pay? How are multiple jobs aggregated?

Handling gig and multi-source income: Handling multiple income sources and gig economy jobs is also crucial, with many renters earning from several gigs, the system should seamlessly combine those streams, not just look for one paycheck.

Customizable, explainable logic: The best solutions show all assumptions in income calculations, or at least allow customization, so that operators can trust the income qualification result.

Advanced Document Fraud Detection: Given the rise of fake pay stubs and bank statements, customers now look for screening products that do more than just collect documents – they need to analyze and verify those documents. The expectation is that the software can perform forgery and tampering detection on uploaded PDFs. This might include checking if the document’s metadata or fonts indicate editing, cross-validating numbers on a paystub against bank deposit records and flagging inconsistencies. Real-time document matching is another sought-after feature. For example, if an applicant submits a paystub and also links a bank account, the system should correlate that the net pay on the stub matches a deposit in the bank statements. Modern screening solutions often embed AI-based document analysis engines (some use third-party APIs like Ocrolus) to instantly vet documents for fraud. In the competitive multifamily market, having this capability is increasingly expected, and institutional operators know that relying on a leasing agent’s eyeballs to spot a doctored PDF or AI-generated document is not enough.

Full Credit & Background Integration: Of course, credit scores and criminal/eviction records still matter – but users now expect more nuance and control in how they’re used. Credit checks have become commoditized so the differentiation is in credit analytics and presentation. Modern platforms might offer a visualized credit report or specific insights (like highlighting recent surges in debt, sudden frequent increases in payday loan inquiries, etc.) beyond just a raw score.

A True National Criminal and Background Check[: For criminal and eviction checks, as discussed, the expectation is true comprehensive coverage with compliance safeguards. An “instant national criminal search” is no longer enough – sophisticated users ask, does it include all states and counties? Are aliases covered? The top screening products tout “true national” criminal searches that automatically comb state and county records (including manual pulls where needed) for a thorough check. They also provide robust false-positive filtering (to avoid misidentifying applicants) and built-in adverse action support to handle notifications if something turns up. Because some legacy screening services have had issues (like not including all states, or showing sealed records), top providers emphasize that they have updated, FCRA-compliant data, and they automatically omit records that shouldn’t be used (e.g. older than 7 years where required). Similarly, for eviction history, the best tools will search nationwide court records and even verify with prior landlords or rent payment databases to get a fuller picture. In essence, best-in-class criminal/eviction checks give operators the full picture but also the tools to use it fairly. The evolving expectation is that a screening report isn’t just a data dump or a white-labeled banking report – it should clearly flag what’s important, perhaps risk-score the findings, and train leasing staff on the best interpretations of the data.

Seamless Workflow and Integration: High-volume operators expect screening solutions to streamline the leasing workflow rather than add friction. This means the software should integrate with the Property Management System (PMS) or leasing CRM so that data flows in and out without double entry. Modern screening platforms expose APIs or have pre-built integrations to systems like Yardi, RealPage, Entrata, etc. For example, when an applicant applies online, their info should pass to the screening system, which returns a result that automatically updates the leasing dashboard. The goal is a one-stop process for leasing agents. Additionally, features like customizable decision criteria are in demand, and institutional owners may want to tweak how much weight is given to credit vs. income vs. rental history. Next-gen products allow clients to configure scoring thresholds or set custom “rules” (for instance, auto-reject if certain criminal felonies, or require extra deposit if credit score in a certain band) – all within legal limits.

For example, Rent Butter includes a simulation capability enabling operators to evaluate the potential impact of different screening rules on historical application outcomes. Other workflow expectations include white-labeled applicant portals (so that the screening process feels like part of the property’s brand, not a third-party site), and real-time compliance updates. In short, a modern screening solution is not a stand-alone utility but a fully integrated part of the leasing pipeline, often with mobile-friendly interfaces, e-signature support for consents, and dashboards that let owners and operators track screening outcomes and fraud attempts.

Summing up, the expectations for tenant screening have evolved towards more verification, more automation, and more transparency. Venture capital dollars and owners and operators are investing in and choosing solutions that offer these capabilities because legacy systems haven’t kept up. A screening solution that does all the above can significantly reduce bad debt and eviction costs, while also speeding up leasing and keeping owners out of legal hot water.

It’s clear that modern tenant screening is no longer a back-office chore, but a strategic function that impacts financial performance, regulatory compliance, and community well-being. Industry associations (like NMHC and NAA) are already shining a light on the issue with surveys and guidelines. With collaboration, stakeholders can begin to share data on fraud trends and common fraud vectors; Property Shield as an example is building a shared fraud database that will enable owners and operators to shine a light on common frauds experienced by the industry as well as shared characteristics of fraudsters (commonly used email addresses, phone numbers, alias, etc.).

With affordability and fair housing in mind, stakeholders should also aim to use these advanced tools not just to exclude risky tenants but to include good tenants who might otherwise be overlooked. For example, better verification might allow a landlord to accept an applicant with non-traditional income or immigrant status by verifying through alternative means, thus broadening the tenant pool responsibly. Rent Butter CEO Chris Rankin writes, “There's real opportunity in looking beyond the traditional file. With the right tools, operators can responsibly approve applicants who've historically been overlooked. Operators don't have to compromise between reducing risk and expanding access. They can do both.”

In closing, embracing next-gen screening and verification is a win-win for the sector: landlords see better financial outcomes and fewer headaches, good tenants are approved faster and more fairly, and the overall rental community becomes safer and more trustworthy. The technology is available – it’s up to industry leaders to implement it thoughtfully and consistently. Those who do so will mitigate the ever-growing risks of fraud while maximizing the rewards of steady rental income and peace of mind. In an environment where 93%+ of owners have faced application fraud and new regulations are coming thick and fast, the cost of inaction is simply too high.

—Jaymie Fung Bingham and Aaron Ru