Unlocking Atoms with Bits

A new generation of software tools are helping real estate investors deploy capital faster and smarter. Will they enable institutional LPs to invest in smaller deals at scale?

Thesis Driven is a newsletter series that dives deep into emerging themes and real estate operating models by featuring a handful of GPs executing on each theme. The deep dives will give an investor enough context to understand the trend as well as opportunities for personal introductions to relevant GPs actively executing on opportunities. This week’s letter is focused on the software companies attempting to make real estate investing more scalable.

Deploying capital in sufficient quantities is one of the most significant challenges faced by institutional real estate investors. Small deals and sub-scale opportunities must be passed over regardless of the returns they offer, leading to intense competition for “institutional scale” investment opportunities. Today, we will meet a new generation of companies attempting to make the process of sourcing and vetting real estate investments easier and faster, unlocking smaller-scale deals and opportunities previously off-limits to institutional LPs. In parallel, a new cohort of GPs are bringing a more data-driven, programmatic approach to real estate investing, building their own technology and data sources to gain a competitive edge.

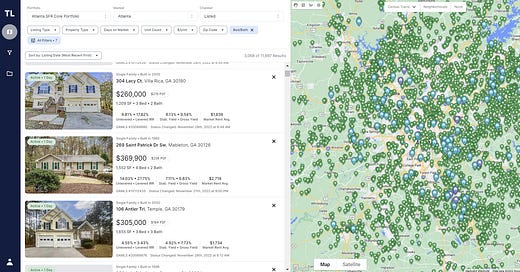

Single-family rental is the one category where technology-driven investing has seen considerable success over the past decade. In some well-known cases—such as Invitation Homes and Amherst—investors built their own proprietary screening and vetting models to deploy capital quickly. In addition, programmatic SFR vetting enabled the growth of iBuying as well as “open” SFR sourcing and vetting platforms like Entera.

Of course, single-family homes represent a relatively easy challenge for programmatic investors in comparison to the rest of the real estate universe. There are over 80 million single family homes in the United States, and they are—within the constraints of zip code and construction vintage—remarkably similar. A 3-bedroom, 2.5-bath home built in the 1990s in suburban Phoenix is as close to a commodity product as one gets in the real estate world. In contrast, an existing multifamily asset or an infill development site offers an order of magnitude more variables and challenges for an automated sourcing and underwriting platform to work through. For simplicity’s sake, this letter will focus on the new generation of companies tackling the latter, tougher challenges.